Increased Focus on Sustainability

Sustainability is becoming a central theme in the Agile IoT Market in India, as organizations strive to reduce their environmental impact. The integration of IoT technologies enables businesses to monitor and optimize resource usage, leading to more sustainable operations. For instance, smart agriculture solutions are being adopted to minimize water consumption and enhance crop yields. Reports indicate that the market for sustainable IoT solutions in India is expected to reach $5 billion by 2026, reflecting a growing awareness of environmental issues. This focus on sustainability is likely to drive innovation within the agile iot market, as companies develop solutions that align with eco-friendly practices.

Government Initiatives and Support

Government initiatives aimed at promoting digital transformation are significantly influencing the Agile IoT Market in India. Programs such as Digital India and Make in India are designed to foster innovation and encourage the adoption of advanced technologies. These initiatives provide financial incentives and support for startups and established companies alike, facilitating the development of agile iot solutions. The Indian government has allocated approximately $1 billion to enhance the digital infrastructure, which is expected to bolster the agile iot market. This support not only enhances the technological landscape but also encourages collaboration between public and private sectors, driving further growth in the agile iot market.

Advancements in Connectivity Technologies

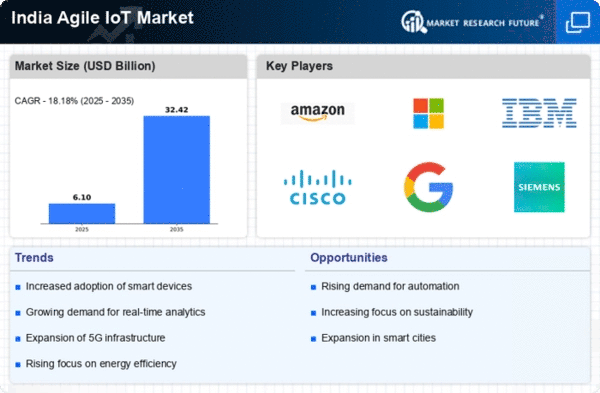

The evolution of connectivity technologies, such as 5G and LPWAN, is playing a crucial role in shaping the Agile IoT Market in India. These advancements facilitate faster and more reliable communication between devices, enabling the deployment of more sophisticated IoT applications. The rollout of 5G networks is expected to enhance the capabilities of IoT devices, allowing for greater data transfer speeds and lower latency. As a result, businesses are increasingly investing in agile iot solutions that leverage these technologies. The Indian government has set a target to roll out 5G services nationwide by 2025, which could significantly impact the agile iot market by enabling new use cases and applications.

Growing Investment in Smart Infrastructure

Investment in smart infrastructure is a key driver of the Agile IoT Market in India. As urbanization accelerates, cities are increasingly adopting smart technologies to improve efficiency and quality of life. Initiatives to develop smart cities are leading to the implementation of IoT solutions in areas such as traffic management, waste management, and energy efficiency. The Indian government has earmarked approximately $15 billion for smart city projects, which is expected to create substantial opportunities for the agile iot market. This investment not only enhances urban living but also encourages the development of innovative solutions that can adapt to the dynamic needs of urban environments.

Rising Demand for Real-Time Data Processing

The Agile IoT Market in India is experiencing a notable surge in demand for real-time data processing capabilities. As businesses increasingly rely on instantaneous insights to drive decision-making, the need for agile solutions that can process vast amounts of data in real-time becomes paramount. This trend is particularly evident in sectors such as manufacturing and logistics, where operational efficiency is critical. According to recent estimates, the market for real-time data analytics in India is projected to grow at a CAGR of 25% over the next five years. This growth is likely to propel the agile iot market, as organizations seek to implement systems that can adapt quickly to changing data inputs and operational conditions.