Rise of Predictive Maintenance Solutions

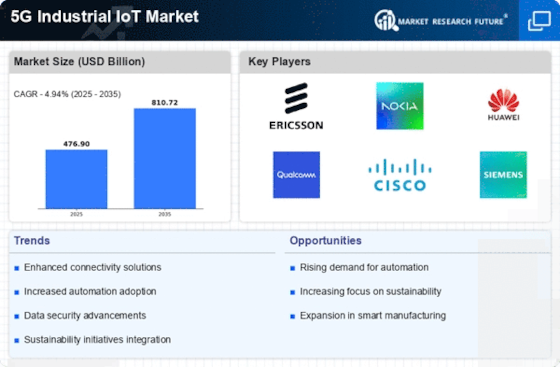

The 5G Industrial IoT Market is experiencing a notable rise in predictive maintenance solutions. Industries are increasingly adopting IoT technologies to monitor equipment health and predict failures before they occur. This proactive approach not only reduces downtime but also minimizes maintenance costs. The predictive maintenance market is anticipated to grow significantly, with estimates suggesting it could reach billions in revenue by 2025. The implementation of 5G technology enhances the effectiveness of these solutions by providing real-time data transmission and analytics capabilities. As a result, the 5G Industrial IoT Market is likely to see accelerated adoption of predictive maintenance strategies across various sectors.

Growing Focus on Supply Chain Optimization

The 5G Industrial IoT Market is being driven by a growing focus on supply chain optimization. Companies are increasingly recognizing the importance of efficient supply chain management in enhancing competitiveness. The integration of 5G technology with IoT devices allows for real-time tracking and monitoring of goods throughout the supply chain. This capability is expected to lead to improved inventory management and reduced operational costs. Recent studies indicate that organizations implementing IoT solutions for supply chain optimization can achieve cost savings of up to 30%. Consequently, the 5G Industrial IoT Market is poised for growth as businesses seek to enhance their supply chain processes.

Expansion of Smart Manufacturing Initiatives

The 5G Industrial IoT Market is significantly influenced by the expansion of smart manufacturing initiatives. As manufacturers adopt advanced technologies, the integration of IoT devices with 5G networks enhances automation and operational efficiency. The smart manufacturing sector is expected to grow at a remarkable rate, with projections indicating a compound annual growth rate of over 10% in the coming years. This growth is attributed to the increasing need for flexibility, customization, and efficiency in production processes. The 5G Industrial IoT Market stands to benefit from this trend, as manufacturers leverage high-speed connectivity to optimize supply chains and improve product quality.

Increased Demand for Real-Time Data Processing

The 5G Industrial IoT Market is witnessing a surge in demand for real-time data processing capabilities. As industries increasingly rely on data-driven decision-making, the ability to process vast amounts of data instantaneously becomes crucial. This demand is driven by the need for enhanced operational efficiency and predictive maintenance. According to recent estimates, the market for real-time data analytics in industrial applications is projected to reach substantial figures by 2026. The integration of 5G technology facilitates faster data transmission, enabling industries to harness insights from IoT devices in real-time. Consequently, this trend is likely to propel the growth of the 5G Industrial IoT Market, as organizations seek to leverage data for competitive advantage.

Advancements in Industrial Automation Technologies

The 5G Industrial IoT Market is significantly impacted by advancements in industrial automation technologies. As industries strive for greater efficiency and productivity, the adoption of automation solutions is on the rise. The market for industrial automation is projected to grow substantially, with estimates suggesting a compound annual growth rate of over 8% in the next few years. The integration of 5G technology enhances the capabilities of automation systems by enabling faster communication between devices and systems. This advancement allows for more sophisticated automation solutions, which are essential for modern manufacturing environments. Thus, the 5G Industrial IoT Market is likely to benefit from the ongoing evolution of industrial automation.