Advancements in Sensor Technology

Advancements in sensor technology are playing a pivotal role in the growth of the industrial iot-platform market. The development of more sophisticated and cost-effective sensors enables manufacturers to collect vast amounts of data from their operations. These sensors facilitate real-time monitoring of equipment and processes, leading to improved predictive maintenance and reduced downtime. The integration of advanced sensors is expected to enhance the capabilities of IoT platforms, making them more attractive to businesses. As sensor technology continues to evolve, it is likely to drive further adoption of IoT solutions in the industrial sector.

Government Initiatives and Funding

Government initiatives aimed at promoting digital transformation in manufacturing are significantly impacting the industrial iot-platform market. Various federal and state programs are providing funding and resources to support the adoption of IoT technologies. For instance, the Department of Commerce has launched initiatives to enhance the competitiveness of U.S. manufacturers through advanced technologies. Such support is crucial, as it encourages small and medium-sized enterprises to invest in IoT solutions, thereby expanding the market. The financial backing from government sources is expected to contribute to a projected increase in market size, potentially reaching $50 billion by 2027.

Growing Focus on Operational Efficiency

The industrial iot-platform market is being driven by an increasing focus on operational efficiency among manufacturers. Companies are seeking to streamline processes, reduce waste, and enhance productivity through the implementation of IoT solutions. This drive for efficiency is often linked to the need for cost reduction and improved profit margins. As a result, many organizations are investing in IoT platforms that facilitate automation and real-time monitoring. Reports indicate that businesses adopting IoT technologies can achieve operational cost savings of up to 30%. This trend underscores the critical role of IoT in transforming traditional manufacturing practices.

Rising Demand for Real-Time Data Analytics

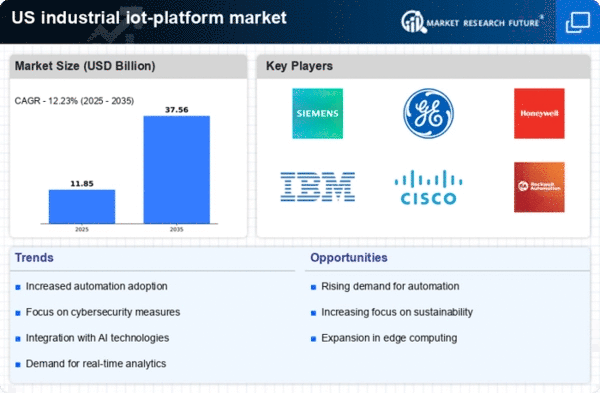

The industrial iot-platform market is experiencing a notable surge in demand for real-time data analytics. This trend is driven by the need for manufacturers to enhance operational efficiency and decision-making processes. Companies are increasingly leveraging data analytics to monitor equipment performance, predict maintenance needs, and optimize production schedules. According to recent estimates, the market for data analytics in industrial applications is projected to grow at a CAGR of approximately 25% over the next five years. This growth is indicative of the broader shift towards data-driven strategies within the industrial sector, which is likely to propel the industrial iot-platform market further.

Increased Collaboration Between Industry and Technology Providers

The industrial iot-platform market is witnessing increased collaboration between traditional manufacturing industries and technology providers. This partnership is essential for developing tailored IoT solutions that meet specific industry needs. By working together, manufacturers can leverage the expertise of technology firms to implement innovative IoT applications that enhance productivity and efficiency. Such collaborations are expected to lead to the creation of customized platforms that address unique operational challenges. As these partnerships grow, they are likely to foster a more robust ecosystem for the industrial iot-platform market, driving further innovation and adoption.