Cost Efficiency

Cost efficiency is a significant driver in the In Pipe Inspection Robot Market. The use of inspection robots can substantially reduce operational costs associated with traditional inspection methods. By minimizing the need for manual labor and reducing downtime during inspections, companies can achieve significant savings. Furthermore, the ability of these robots to provide detailed data allows for targeted maintenance, preventing unnecessary expenditures. As organizations increasingly seek to optimize their budgets, the demand for cost-effective inspection solutions is likely to rise. Market forecasts indicate a potential growth rate of around 11%, as businesses recognize the financial benefits of adopting robotic inspection technologies.

Regulatory Support

Regulatory support plays a crucial role in the growth of the In Pipe Inspection Robot Market. Governments are increasingly recognizing the importance of infrastructure maintenance and safety, leading to the establishment of stringent regulations regarding pipeline inspections. These regulations often mandate the use of advanced inspection technologies to ensure compliance and safety standards. Consequently, this has created a favorable environment for the adoption of inspection robots, as they provide a reliable solution for meeting regulatory requirements. The market is likely to benefit from this trend, as companies seek to align their operations with evolving regulations, potentially driving a market growth rate of around 12% in the coming years.

Aging Infrastructure

The aging infrastructure in many regions is a pressing concern that is driving the In Pipe Inspection Robot Market. Many pipelines and sewer systems are reaching the end of their operational lifespan, leading to increased maintenance challenges and safety risks. Inspection robots offer a proactive solution to assess the condition of these aging systems, allowing for timely repairs and replacements. The market is expected to grow as municipalities and utility companies recognize the need for regular inspections to prevent costly failures. Estimates suggest that the market could expand by 14% over the next few years, as stakeholders prioritize infrastructure integrity and safety.

Increased Urbanization

The rapid pace of urbanization is significantly influencing the In Pipe Inspection Robot Market. As urban areas expand, the demand for efficient infrastructure management becomes paramount. This growth leads to an increase in the complexity and volume of underground utilities, necessitating advanced inspection solutions. Inspection robots are becoming essential tools for municipalities and utility companies to monitor and maintain their pipeline systems effectively. The market is projected to witness a growth rate of approximately 10% annually, driven by the need for proactive maintenance strategies in urban settings. This trend indicates a shift towards more sustainable urban infrastructure management practices.

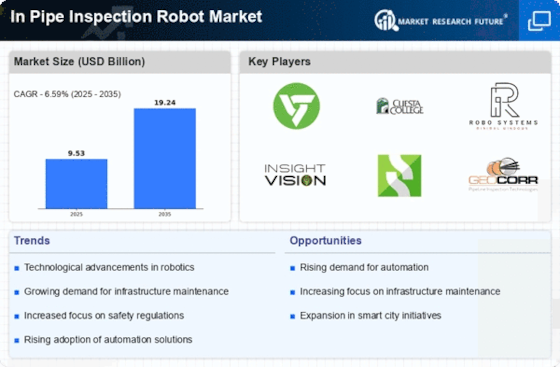

Technological Advancements

The In Pipe Inspection Robot Market is experiencing a surge in technological advancements, which are enhancing the capabilities of inspection robots. Innovations such as high-definition cameras, advanced sensors, and artificial intelligence are enabling these robots to perform more complex inspections with greater accuracy. For instance, the integration of machine learning algorithms allows for real-time data analysis, improving decision-making processes. As a result, the demand for these advanced inspection solutions is expected to grow, with projections indicating a market expansion of approximately 15% annually over the next five years. This trend suggests that companies are increasingly investing in cutting-edge technologies to improve operational efficiency and reduce maintenance costs.