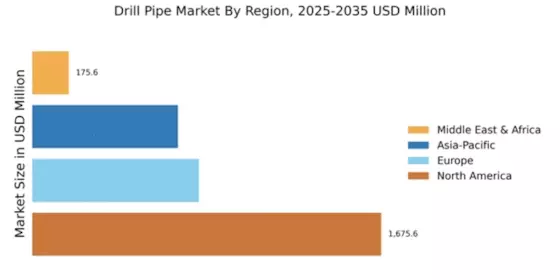

Market Growth Projections

The Global Drill Pipe Market is projected to experience substantial growth over the next decade. With a market size of 3.35 USD Billion in 2024, the industry is expected to expand significantly, reaching an estimated 25.3 USD Billion by 2035. This growth trajectory is supported by a compound annual growth rate (CAGR) of 20.18% from 2025 to 2035. Such projections indicate a robust demand for drill pipes, driven by factors such as increased energy consumption, technological advancements, and investment in exploration activities. The market's potential highlights the importance of strategic planning and investment in the Global Drill Pipe Market Industry.

Rising Demand for Energy Resources

The Drill Pipe Market experiences a surge in demand driven by the increasing need for energy resources. As countries strive to meet their energy requirements, the exploration and production of oil and gas become paramount. This trend is evidenced by the projected market size of 3.35 USD Billion in 2024, indicating a robust growth trajectory. The industry's expansion is further supported by technological advancements in drilling techniques, which enhance efficiency and reduce operational costs. Consequently, the Global Drill Pipe Market Industry is poised for significant growth as energy demands escalate.

Technological Advancements in Drilling

Technological innovations play a crucial role in shaping the Drill Pipe Industry. The introduction of advanced drilling technologies, such as rotary steerable systems and managed pressure drilling, enhances drilling efficiency and safety. These advancements not only reduce drilling time but also minimize environmental impact, aligning with global sustainability goals. As a result, the market is expected to witness substantial growth, with a projected CAGR of 20.18% from 2025 to 2035. This growth is indicative of the industry's adaptability to evolving technological landscapes, ensuring that the Global Drill Pipe Market Industry remains competitive and responsive to market demands.

Growing Focus on Renewable Energy Integration

The Drill Pipe Market is witnessing a shift towards integrating renewable energy sources with traditional oil and gas operations. As the world transitions to cleaner energy, hybrid drilling techniques that combine conventional and renewable methods are gaining traction. This integration not only enhances operational efficiency but also aligns with global sustainability initiatives. The industry's ability to adapt to these changes is crucial for its long-term viability. As a result, the Global Drill Pipe Market Industry is likely to benefit from this trend, positioning itself as a key player in the evolving energy landscape.

Increasing Investment in Oil and Gas Exploration

Investment in oil and gas exploration is a significant driver of the Drill Pipe Market. As energy companies allocate substantial resources towards exploration activities, the demand for drill pipes intensifies. This trend is particularly evident in regions rich in untapped reserves, where exploration efforts are ramping up. The anticipated growth in the market, reaching 25.3 USD Billion by 2035, underscores the importance of exploration investments. Furthermore, government policies promoting energy independence and resource development further bolster the industry's prospects, indicating a robust future for the Global Drill Pipe Market Industry.

Regulatory Framework and Environmental Considerations

The Drill Pipe Market is influenced by regulatory frameworks and environmental considerations that shape operational practices. Stricter regulations aimed at minimizing environmental impact necessitate the adoption of advanced drilling technologies and practices. Companies are increasingly investing in eco-friendly solutions to comply with these regulations, which, in turn, drives demand for innovative drill pipes. This regulatory landscape not only fosters a culture of sustainability but also presents opportunities for growth within the industry. As environmental concerns continue to rise, the Global Drill Pipe Market Industry is likely to evolve, adapting to meet regulatory requirements while ensuring operational efficiency.