Technological Advancements in Robotics

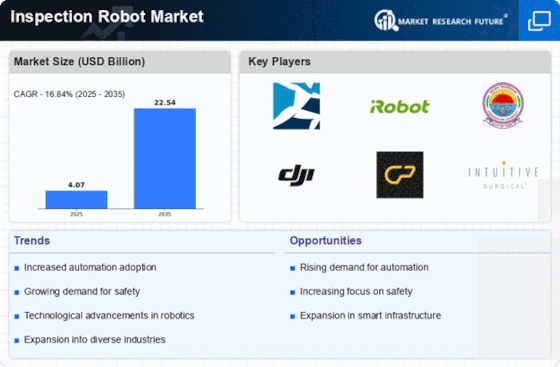

The Inspection Robot Market is experiencing a surge in technological advancements, particularly in robotics and automation. Innovations such as enhanced sensors, machine learning algorithms, and improved mobility are driving the development of more sophisticated inspection robots. These advancements enable robots to perform complex tasks with greater accuracy and efficiency, thereby reducing the need for human intervention in hazardous environments. According to recent data, the market for inspection robots is projected to grow at a compound annual growth rate of approximately 15% over the next five years. This growth is indicative of the increasing reliance on technology to enhance operational efficiency and safety in various sectors, including manufacturing, oil and gas, and infrastructure.

Environmental Sustainability Initiatives

The Inspection Robot Market is also being driven by environmental sustainability initiatives. As organizations seek to reduce their carbon footprint and comply with environmental regulations, the use of inspection robots for monitoring and assessing environmental impact is gaining traction. These robots can efficiently conduct inspections in remote or sensitive areas, providing valuable data for environmental assessments. The ability to monitor emissions, detect leaks, and assess ecological health is becoming increasingly important for companies aiming to meet sustainability goals. Market trends suggest that the demand for inspection robots in environmental applications is likely to rise, further contributing to the growth of the Inspection Robot Market.

Rising Demand for Safety and Risk Mitigation

The Inspection Robot Market is significantly influenced by the rising demand for safety and risk mitigation across various sectors. Organizations are increasingly adopting inspection robots to minimize human exposure to dangerous environments, such as chemical plants, nuclear facilities, and construction sites. The ability of these robots to conduct inspections in high-risk areas not only enhances safety but also ensures compliance with stringent regulatory standards. As industries face mounting pressure to adhere to safety regulations, the adoption of inspection robots is likely to increase. Market data suggests that sectors such as energy and utilities are expected to invest heavily in robotic inspection solutions, further propelling the growth of the Inspection Robot Market.

Increased Investment in Infrastructure Development

The Inspection Robot Market is poised for growth due to increased investment in infrastructure development. Governments and private entities are allocating substantial resources to upgrade and maintain critical infrastructure, including bridges, roads, and pipelines. Inspection robots play a crucial role in this context, as they facilitate efficient monitoring and assessment of structural integrity. The ability to conduct real-time inspections reduces downtime and maintenance costs, making these robots an attractive option for infrastructure projects. Recent reports indicate that the infrastructure sector is expected to witness a significant uptick in the adoption of robotic inspection technologies, thereby driving the overall growth of the Inspection Robot Market.

Growing Adoption of Automation in Industrial Processes

The Inspection Robot Market is benefiting from the growing adoption of automation in industrial processes. As industries strive for operational efficiency and cost reduction, the integration of inspection robots into production lines and maintenance routines is becoming increasingly common. These robots not only enhance productivity but also improve the quality of inspections by providing consistent and accurate data. The manufacturing sector, in particular, is witnessing a shift towards automated inspection solutions, with many companies investing in robotic technologies to streamline their operations. Market analysis indicates that this trend is likely to continue, with the Inspection Robot Market expected to expand as more industries recognize the advantages of automation.