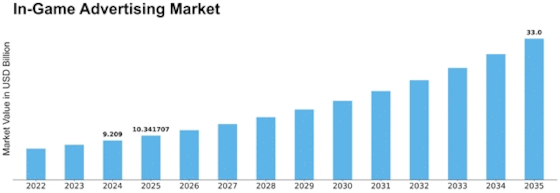

In Game Advertising Size

In-Game Advertising Market Growth Projections and Opportunities

The In-Game Advertising market is influenced by various factors that collectively shape its trajectory and impact its growth. One of the primary drivers is the increasing prevalence and popularity of video games as a form of entertainment. With a global gaming audience numbering in the billions, advertisers recognize the immense potential of reaching consumers within the gaming environment. As gamers spend more time immersed in virtual worlds, the opportunities for in-game advertising to capture their attention and engage them in a meaningful way have expanded significantly. Technological advancements play a pivotal role in shaping the In-Game Advertising market.

The evolution of gaming platforms, graphics capabilities, and online multiplayer experiences has created more sophisticated and immersive gaming environments. Advertisers leverage these advancements to seamlessly integrate ads into the gaming experience. Dynamic in-game placements, such as branded items, billboards, and sponsored events, capitalize on the technology to enhance brand visibility without disrupting the gaming flow. Demographic shifts and changing gaming habits contribute significantly to market dynamics. The gaming audience is diverse, spanning across age groups, genders, and regions. Advertisers keen on connecting with specific demographics can tailor their in-game campaigns accordingly.

Understanding the preferences of gamers and aligning advertising content with their interests become crucial for success in the In-Game Advertising market. Additionally, the rise of casual gaming and mobile gaming has broadened the reach of in-game ads to a wider and more varied audience. Market factors are also influenced by the blend of virtual and real-world economies within games. In-game purchases, virtual currency, and virtual goods have become integral components of many gaming experiences. Advertisers strategically align their campaigns with these virtual economies, creating opportunities for branded content, promotions, and partnerships. The intertwining of the virtual and real-world economies within games adds a layer of complexity and creativity to in-game advertising strategies.

Leave a Comment