Market Growth Projections

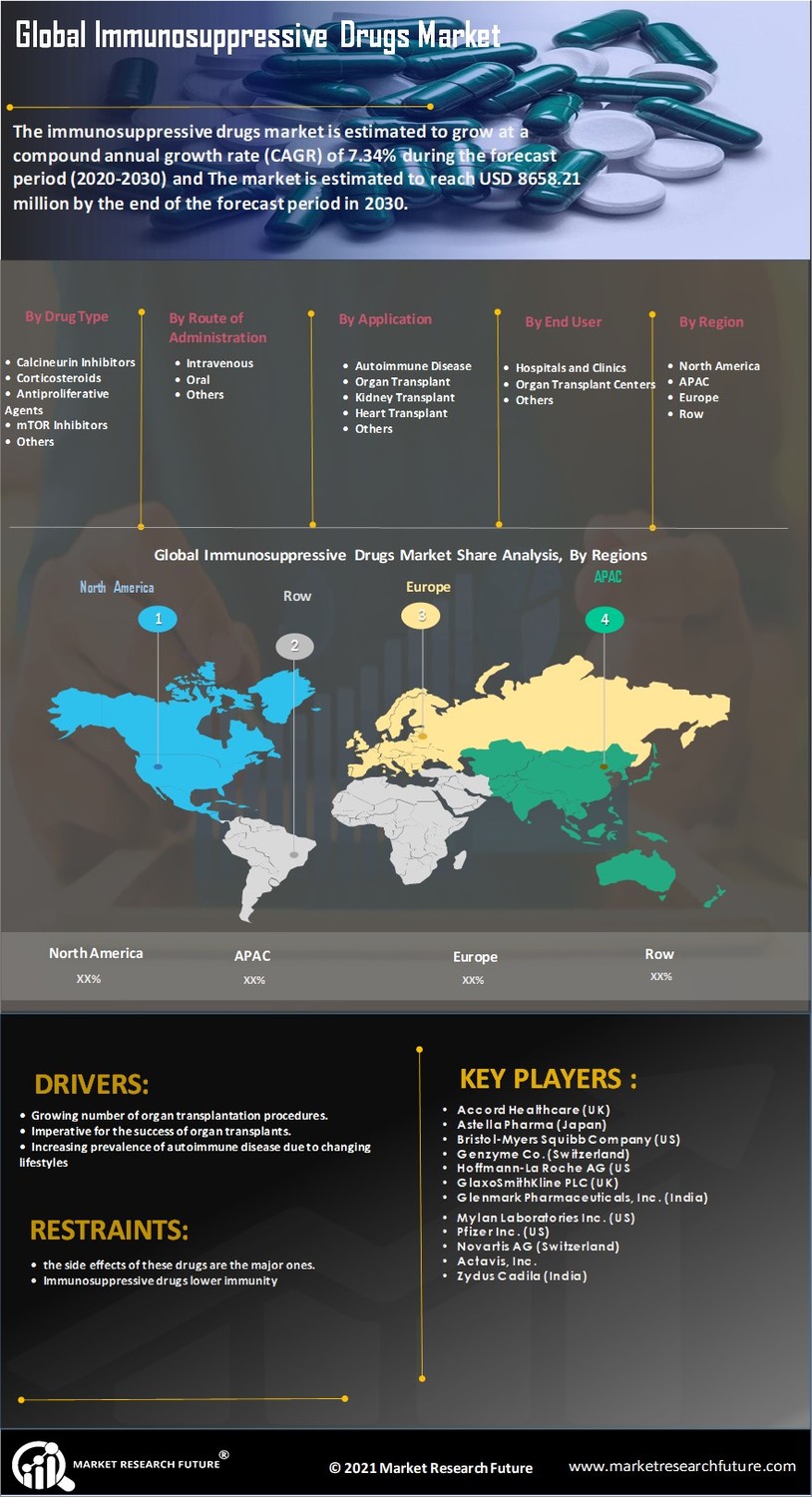

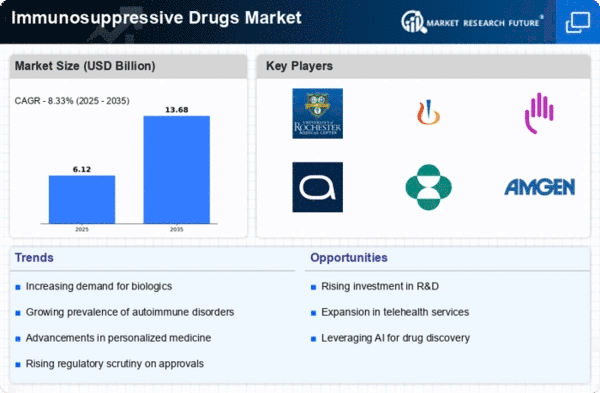

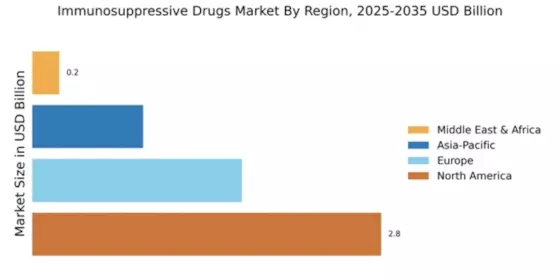

The Global Immunosuppressive Drugs Market Industry is projected to experience substantial growth over the next decade. With an estimated value of 5.12 USD Billion in 2024, the market is expected to reach 12.4 USD Billion by 2035, reflecting a robust compound annual growth rate of 8.37% from 2025 to 2035. This growth trajectory indicates a strong demand for immunosuppressive therapies driven by various factors, including the rising prevalence of autoimmune diseases, advancements in drug development, and increasing organ transplantation procedures. The market's expansion is indicative of the critical role immunosuppressive drugs play in modern medicine.

Growing Awareness and Education

The increasing awareness and education regarding autoimmune diseases and organ transplantation are pivotal for the Global Immunosuppressive Drugs Market Industry. Enhanced public knowledge leads to earlier diagnosis and treatment, which is essential for managing these conditions effectively. Healthcare providers are also becoming more informed about the latest treatment options, contributing to improved patient outcomes. Campaigns and initiatives aimed at educating both patients and healthcare professionals are likely to drive demand for immunosuppressive therapies. This heightened awareness is expected to support the growth of the Global Immunosuppressive Drugs Market Industry in the coming years.

Advancements in Drug Development

Innovations in drug development are significantly impacting the Global Immunosuppressive Drugs Market Industry. The emergence of biologics and targeted therapies offers new avenues for treating complex conditions. These advancements not only enhance efficacy but also reduce side effects compared to traditional therapies. For example, monoclonal antibodies have revolutionized treatment protocols for various autoimmune diseases. The ongoing research and development efforts are expected to yield more effective immunosuppressive agents, thereby expanding the market. The Global Immunosuppressive Drugs Market Industry is anticipated to grow at a CAGR of 8.37% from 2025 to 2035, indicating a robust pipeline of new therapies.

Regulatory Support and Approvals

Regulatory support and streamlined approval processes for immunosuppressive drugs are vital for the Global Immunosuppressive Drugs Market Industry. Governments and health authorities are increasingly recognizing the need for effective treatments for autoimmune diseases and transplant patients. Initiatives to expedite the approval of new therapies can significantly enhance market dynamics. For instance, the U.S. Food and Drug Administration has implemented programs to facilitate faster access to innovative treatments. This supportive regulatory environment is likely to encourage pharmaceutical companies to invest in research and development, thereby expanding the Global Immunosuppressive Drugs Market Industry.

Rising Prevalence of Autoimmune Diseases

The increasing incidence of autoimmune diseases globally drives the Global Immunosuppressive Drugs Market Industry. Conditions such as rheumatoid arthritis, lupus, and multiple sclerosis are becoming more prevalent, necessitating effective treatment options. For instance, the World Health Organization reports a rising trend in autoimmune disorders, which may lead to a higher demand for immunosuppressive therapies. As the global population ages, the burden of these diseases is likely to escalate, further propelling market growth. The Global Immunosuppressive Drugs Market Industry is projected to reach 5.12 USD Billion in 2024, reflecting the urgent need for innovative therapeutic solutions.

Increasing Organ Transplantation Procedures

The rise in organ transplantation procedures globally serves as a crucial driver for the Global Immunosuppressive Drugs Market Industry. As more individuals require organ transplants due to chronic diseases, the demand for immunosuppressive drugs to prevent organ rejection becomes paramount. According to the Global Observatory on Donation and Transplantation, the number of organ transplants has steadily increased, necessitating effective immunosuppressive regimens. This trend is likely to continue, with the market expected to reach 12.4 USD Billion by 2035. The need for tailored immunosuppressive therapies to improve transplant outcomes underscores the importance of this market.