Market Analysis

In-depth Analysis of Immunosuppressive Drugs Market Industry Landscape

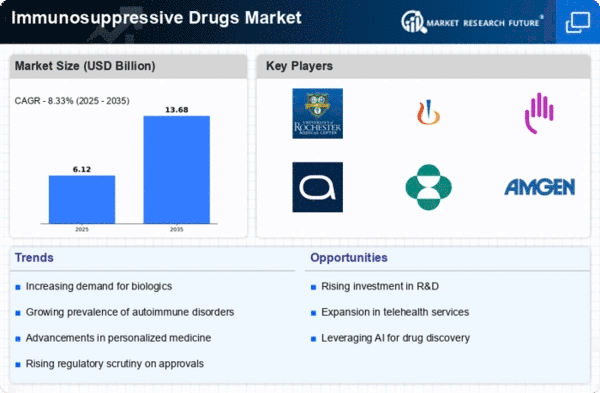

The market dynamics of immunosuppressive drugs are influenced by organ transplantation and autoimmune diseases in a manner that the picture becomes more and more complex as medical treatments evolves and population pressure on immune system increase. One of the major causes is the growing public awareness about organ transplantations in the world and a need for immunosuppressants to avoid the rejection of transplant. The easy accessibility of the techniques of the organ transplantation increases the consumption of immunosuppressive drugs thus, pointing to the necessity of the development of the selective and potent drugs that would be able to manage the delicate balance between the suppression of the immunity and preventing infections.

Technological evolution emerges as the key factor transforming the immunosuppressive drugs clinical picture. Advances in drugs development means invention of specific suppressors that are very effective for the immune system. This ultimately leads to medications that are more effective with fewer side effects. It becomes possible to engineer immunosuppression regimens according to patient profiles and error reduction contributing significantly to the market trend of personalized therapy and patient-centered approach.

The regulatory aspect or view is utterly pivotal to the market of immunosuppressive drugs. Regulations that govern the accreditation, stability, and performance of immunosuppressive drugs guarantee their reliability and efficacy. The regulatory standards for the development and commercialization of these medicines can be considered as a avenue of trust for health professionals and patients. Observance of these norms affects the market dynamics in terms of opportunities arising from drug supplies for immune suppression and safety for patients.

Global economic factors have a strong impact on immunosuppressive drugs market dynamics by either raising or lowering their accessibility and treatment cost. Healthcare investments can be made more than just by becoming economically developed countries that saw increased levels of spending. However, economic problems can also influence the budgetary decisions in healthcare, thereby giving them a preference toward those drugs which are cost-effective yet effective; which in turn can be considered a market trend in different economic conditions.

The competition among immunosuppressive medicines in the market tends to be stimulated by the presence of a large number of pharmaceutical companies. Factors – for example, the effectiveness of drugs, the safety profiles, the patient compliance and the market share may represent the key positioning of the companies in the market. In the cooperation, partnering and development of research projects of many industry partners breath new life into immunosuppressive drugs and establish the scenario of the market.

Research partnerships and clinical trials are two pillars which will take the immunosuppressive drug to its significance and meet the changing clinical necessities. It is the contribution to scientific research that helps one to grasp better the process of immune mechanism, treatment outcomes, and side effects. The ongoing improvement attributable to the scientific drive and clinical studies leads to the emergence of immunosuppressive drugs capable of staying up-to-date and current with the latest medical knowledge.

Leave a Comment