Immuno Oncology Assay Market Summary

As per Market Research Future analysis, the Immuno-oncology Assay Market Size was estimated at USD 3,954.87 Million in 2024. The Immuno-oncology Assay industry is projected to grow from USD 4,399.79 Million in 2025 to 12,406.18 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 10.9% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Immuno-oncology Assay Market is experiencing robust growth driven by Rising incidence of cancer and government & private funding for cancer research.

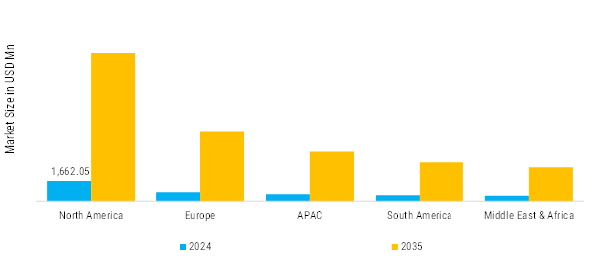

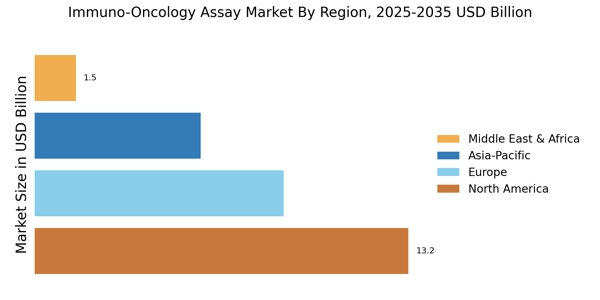

- The immuno-oncology assay market in North America is growing rapidly, supported by rising cancer prevalence and the expanding use of immunotherapies such as checkpoint inhibitors and CAR-T treatments. This is driving strong demand for advanced diagnostic assays, further reinforced by active clinical research, increasing precision-medicine adoption, and ongoing R&D investment across the region.

- Rapid adoption of precision oncology and biomarker-based treatment selection is becoming a focal point across the Asia-Pacific region, positioning it as the fastest-growing market for immuno-oncology assays

- Reagents & kits remain the dominant product category, driven by their essential role in immune response measurement, biomarker identification, and standardized assay workflows.

- Instruments are witnessing rapid uptake as advanced platforms such as flow cytometers, multiplex analyzers, and live-cell imaging systems gain traction for high-precision immuno-oncology research.

- Immune cell profiling assays lead the market, supported by growing reliance on flow cytometry, CyTOF, IHC, and single cell sequencing for granular characterization of immune responses.

- Tumor mutation burden (TMB) assays are expanding rapidly, fueled by increasing adoption of genomic biomarker testing to guide immunotherapy selection.

Market Size & Forecast

| 2024 Market Size | 3,954.87 (USD Million) |

| 2035 Market Size | 12,406.18 (USD Million) |

| CAGR (2025 - 2035) | 10.92% |

Major Players

THERMO Fisher Scientific Inc, Qiagen, Merck KGAA, Sartorius Ag, F. Hoffmann-La Roche Ltd., and Agilent Technologies Inc.