Top Industry Leaders in the Image Intensifier Tube Market

Competitive Landscape of the Image Intensifier Tube Market

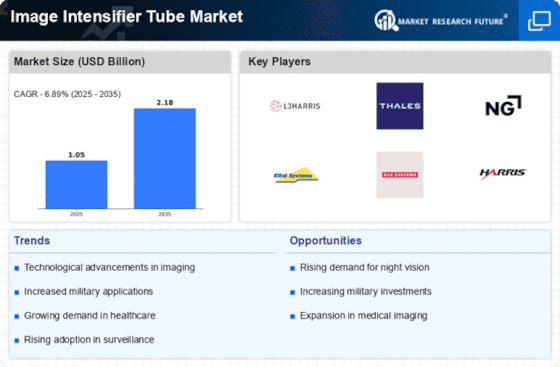

The image intensifier tube market, a niche yet crucial sector within the broader night vision technology landscape, is witnessing a dynamic interplay between established players and emerging contenders. Understanding this competitive landscape is vital for stakeholders seeking to navigate the market's complexities and capitalize on its growth potential.

Some of the Image Intensifier Tube companies listed below:

- IRIS USA

- B&W Medical International Limited

- Medline Industries Inc.

- ONEX Corporation Ltd.

- Night Hawk Technology Inc.

- Terumo Corporation Ltd.

- TYCO Healthcare Group LLC

Factors Shaping Market Share:

- Technology Advancements: The relentless pursuit of improved resolution, sensitivity, and miniaturization drives market share. Players like FLIR Systems are pushing the boundaries with their digital night vision scopes, offering enhanced clarity and integration with other technologies.

- Defense Spending: The fluctuations in defense budgets across regions significantly impact market share. Increased spending in countries like India and China opens doors for established players and challengers alike.

- Regulations and Export Controls: Stringent regulations governing the use and export of IITs can create barriers for certain players. Companies with strong compliance infrastructures and established relationships with government agencies gain an edge.

- Cost and Performance Balance: Striking the right balance between cost and performance is crucial. While established players offer premium IITs, emerging players cater to budget-conscious buyers with cost-effective alternatives.

New and Emerging Companies:

- Start-ups like e-Optics and Photon Security are disrupting the market with innovative solutions. e-Optics focuses on uncooled thermal imaging sensors, offering cost-effective alternatives for commercial and consumer applications. Photon Security develops advanced IITs with enhanced image processing and cyber-security features, catering to sensitive government and military needs.

- Universities and research institutions are also playing a role, developing next-generation IIT technologies like GaN-based tubes and organic photodetectors. These advancements hold immense potential to revolutionize the market in the future.

Latest Company Updates:

On Jun. 15, 2022, the U.S. military selected electro-optical image-intensifier tubes for various night-vision devices and weapons sights from L3Harris Technologies and Elbit Systems of America. MX-11769 has a high-efficiency GaAs photocathode bonded to a glass input window and a microchannel plate (MCP) current amplifier. The MX-11769 also has a variable-gain power supply that enables the user to adjust the tube gain or brightness in the field.

On Aug.05, 2022, The Bulgarian Company Optix announced the development of futuristic thermal imaging & night vision devices, day scopes, and integrated systems for strategic surveillance and security. Optix is one of the first few companies in Bulgaria to obtain certification by NATO standards AQAP 2110. Available image intensifier tubes are 2+, 3rd Gen, XD-4, XR-5, and XR-5 ONYX. The innovative wide exit pupil feature eliminates the need for interpupillary adjustment and allows the operator to use them in critical conditions.

On Dec. 01, 2020, Photonics, a leading global provider of state-of-the-art night vision Image Intensifier Tubes for military and commercial applications, launched its series of night vision goggles, Photonis Defense Professional (PD-PRO), built around their 16mm and hybrid 18mm 4G filmless image intensifier tubes. These systems are the USA's smallest, lightest and best-performing night vision systems and are aimed at professionals and consumers who require military-grade equipment so they can see at night for safety, security, or scientific reasons.

On Nov.13, 2020, THEON SENSORS announced new strategic partnerships and the completion of delivery of 100,000 systems. Theon offers a variety of night vision binoculars, with 18 and 16-mm image intensifier tubes and standard or wide field of view, with all systems being based on the immensely successful and fully battle-proven NYX. This milestone was achieved by delivering the first tranche of THEON's best-selling NYX night vision binoculars to the Austrian Armed and Special Forces following the award of a framework contract in November 2019.