Cost-Effectiveness

Cost-effectiveness remains a vital driver for the US Led Lighting Market. Although the initial investment in LED lighting may be higher than traditional options, the long-term savings on energy bills and maintenance costs make LEDs a financially attractive choice. In 2025, it was reported that businesses and homeowners could save up to 75% on energy costs by switching to LED lighting. This financial incentive is particularly appealing in commercial sectors, where operational costs are closely monitored. The increasing availability of affordable LED products is also contributing to market growth, as more consumers recognize the value proposition of LEDs. As awareness of the cost benefits continues to spread, the US Led Lighting Market is likely to see a steady increase in adoption rates across various segments.

Environmental Awareness

Environmental awareness among consumers and businesses is a crucial driver for the US Led Lighting Market. As sustainability becomes a priority, more individuals and organizations are opting for eco-friendly lighting solutions. LED lights are recognized for their lower carbon footprint and reduced energy consumption compared to traditional lighting options. In 2025, surveys indicated that over 70% of consumers in the US preferred LED lighting due to its environmental benefits. This shift in consumer behavior is prompting manufacturers to focus on sustainable practices in production and distribution. The growing emphasis on corporate social responsibility among businesses further accelerates the adoption of LED lighting solutions. As environmental concerns continue to rise, the US Led Lighting Market is expected to experience sustained growth, driven by the demand for sustainable lighting alternatives.

Technological Advancements

Technological advancements play a pivotal role in shaping the US Led Lighting Market. Innovations in LED technology, such as improved lumens per watt, longer lifespans, and enhanced color rendering, are driving consumer adoption. The integration of smart technologies, including IoT capabilities, allows for greater control and customization of lighting systems. In 2025, the market witnessed a surge in smart LED lighting solutions, with a projected growth rate of 20% annually. This trend indicates a shift towards more intelligent lighting systems that not only provide illumination but also enhance energy management and user experience. As technology continues to evolve, the US Led Lighting Market is expected to see further enhancements in product offerings, catering to the diverse needs of consumers and businesses alike.

Energy Efficiency Regulations

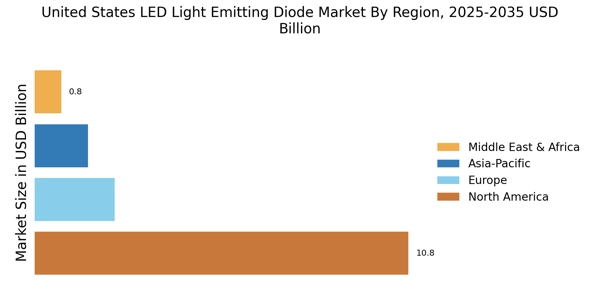

The US Led Lighting Market is significantly influenced by stringent energy efficiency regulations imposed by federal and state governments. The Department of Energy has established standards that mandate higher efficiency levels for lighting products. As a result, manufacturers are compelled to innovate and produce LED lighting solutions that not only comply with these regulations but also exceed them. This regulatory environment fosters a competitive landscape where energy-efficient products gain market traction. In 2025, the market for LED lighting in the US was valued at approximately 10 billion USD, reflecting a growing preference for energy-efficient solutions. The ongoing push for sustainability and reduced energy consumption is likely to further propel the demand for LED lighting in various sectors, including residential, commercial, and industrial applications.

Growing Demand for Smart Homes

The increasing trend towards smart homes is a significant driver for the US Led Lighting Market. Consumers are increasingly seeking integrated lighting solutions that can be controlled remotely via smartphones or voice-activated devices. This demand is fueled by the desire for convenience, energy savings, and enhanced security. In 2025, it was estimated that over 30% of new homes in the US incorporated smart lighting systems, reflecting a shift in consumer preferences. The convergence of LED technology with smart home systems not only improves energy efficiency but also offers customizable lighting experiences. As the smart home market continues to expand, the US Led Lighting Market is likely to benefit from this growing consumer interest, leading to increased sales and innovation in smart LED products.