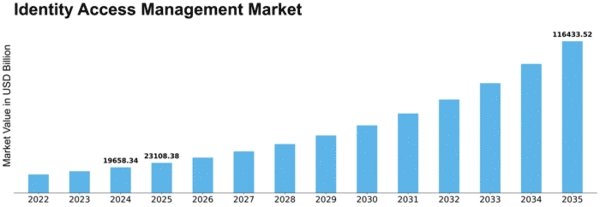

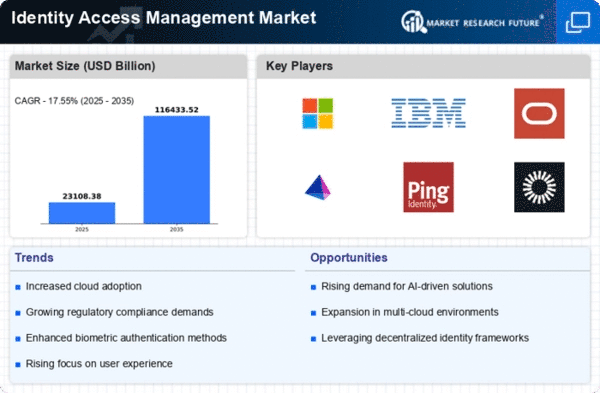

Identity Access Management Size

Identity Access Management Market Growth Projections and Opportunities

Many factors affect the Identity and Access Management (IAM) business. Network safety concerns at a period of wild data breaches and digital threats are a key cause. Strong IAM systems are in demand as companies realize they must protect their sensitive data. Distributed computers and mobile phones increase this need, while traditional safety methods fail despite mechanical advances.

Administrative consistency is crucial to IAM market management. Information assurance standards and recommendations from states and industry groups are forcing organizations to follow strict IAM norms. Compliance with GDPR, HIPAA, and other regulations drives the IAM industry. Thus, enterprises want integrated IAM solutions that boost security and comply with the complicated information protection and insurance regulations.

Remote labor is becoming more common, complicating IAM requirements. Consistent, secure access control is essential for a crucial workforce operating remotely. Adaptable IAM setups that don't compromise security stand out, solving modern workplace issues.

IAM market growth is driven by digital threat refinement. To stay ahead, IAM should evolve as cybercriminals create new methods. This has led IAM frameworks to combine human and AI brainpower to better detect and mitigate risks. IAM development is characterized by the constant arms race between digital attackers and safety attempts.

The IAM landscape depends on market union and critical organizations. As demand for comprehensive IAM solutions rises, companies seek providers with a full spectrum of services. Due to consolidations and acquisitions, IAM players now have specific solutions to complement their contributions. Critical partnerships between IAM sellers and other innovation providers lead to stronger and more coordinated security measures.

Cost concerns continue to affect the IAM market. While robust identity and access management is widely acknowledged, organizations need also alter their budgets. The market offers financial solutions for small businesses and innovative, high-impact solutions for large companies. The IAM market's ability to handle various financial constraints ensures that groups may access customized arrangements.

Leave a Comment