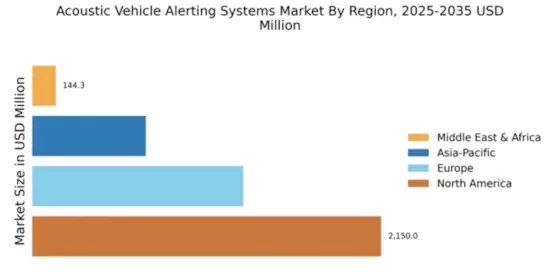

Market Growth Projections

The Global Acoustic Vehicle Alerting Systems Market Industry is poised for substantial growth, with projections indicating a market size of 0.99 USD Billion in 2024 and an anticipated rise to 2.5 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 8.79% from 2025 to 2035, driven by various factors including regulatory compliance, technological advancements, and increasing consumer demand for safety features. As the automotive industry evolves, the integration of acoustic alert systems is becoming increasingly essential, positioning the market for significant expansion in the coming years.

Rising Electric Vehicle Adoption

The increasing adoption of electric vehicles (EVs) is a pivotal driver for the Global Acoustic Vehicle Alerting Systems Market Industry. As more consumers opt for EVs due to environmental concerns and government incentives, the need for effective alert systems becomes paramount. Electric vehicles operate quietly, posing risks to pedestrians who may not hear them approaching. Consequently, manufacturers are integrating acoustic alert systems to enhance safety. The market is anticipated to grow substantially, with projections indicating a rise to 2.5 USD Billion by 2035. This growth is fueled by the expected compound annual growth rate of 8.79% from 2025 to 2035, underscoring the critical role of alert systems in the evolving automotive landscape.

Global Urbanization and Traffic Congestion

The trend of global urbanization and increasing traffic congestion is a notable driver for the Global Acoustic Vehicle Alerting Systems Market Industry. As urban populations grow, the number of vehicles on the road rises, leading to heightened risks for pedestrians. Acoustic alert systems serve as a crucial solution to mitigate these risks, ensuring that vulnerable road users are aware of approaching vehicles. Urban areas, characterized by dense traffic and diverse mobility options, are particularly reliant on these systems to enhance safety. The growing need for effective pedestrian protection in congested environments is likely to stimulate demand for acoustic alert systems, thereby contributing to the overall market expansion.

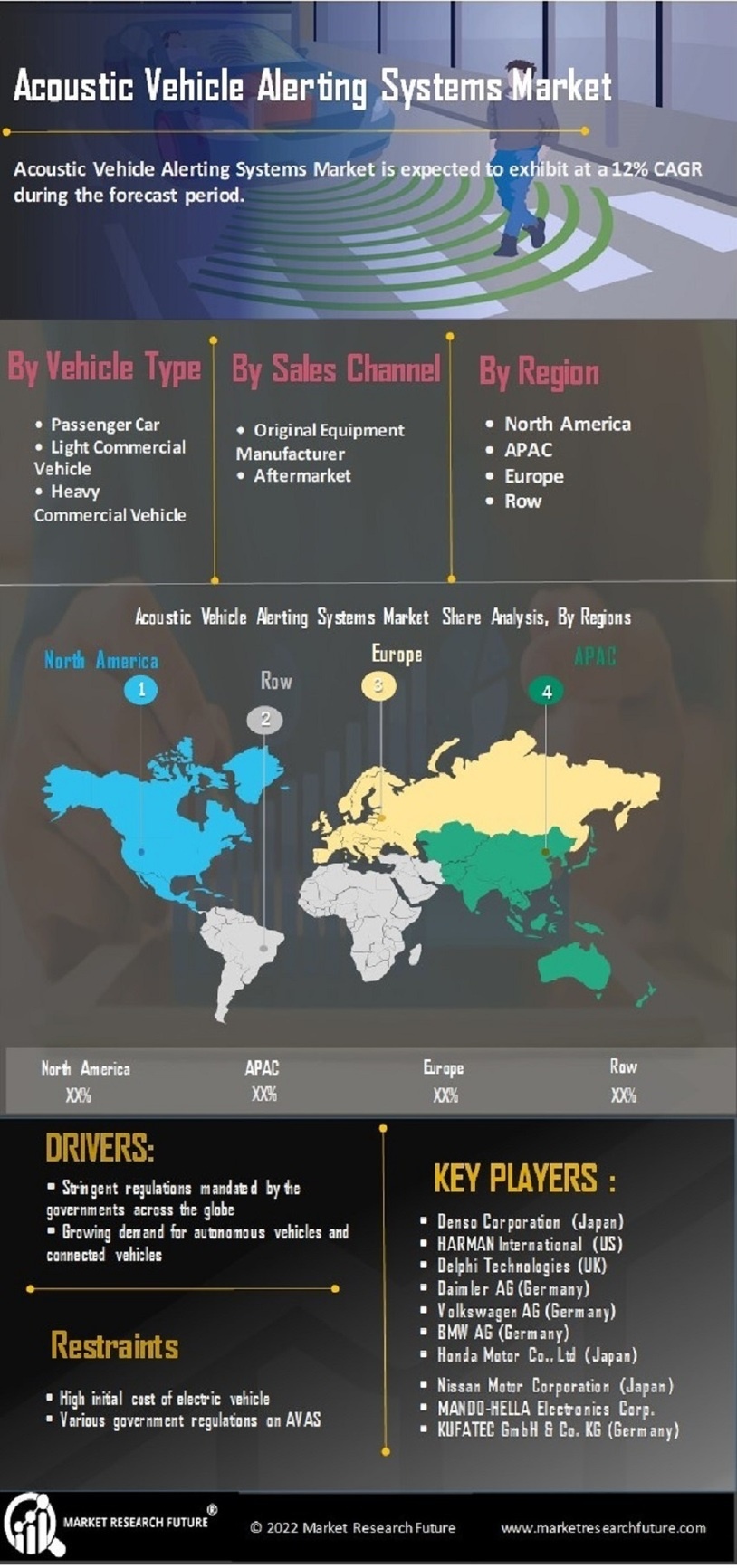

Regulatory Compliance and Safety Standards

The Global Acoustic Vehicle Alerting Systems Market Industry is significantly influenced by stringent regulatory frameworks aimed at enhancing pedestrian safety. Governments worldwide, particularly in regions such as the European Union and North America, have mandated the implementation of acoustic alert systems in electric and hybrid vehicles. This regulatory push is expected to drive the market's growth, as manufacturers must comply with these standards to ensure vehicle safety. For instance, the U.S. National Highway Traffic Safety Administration has established regulations requiring electric vehicles to emit sounds at low speeds, thereby promoting the adoption of these systems. As a result, the market is projected to reach 0.99 USD Billion in 2024, reflecting the urgency of compliance in the automotive sector.

Technological Advancements in Sound Design

Innovations in sound design technology are reshaping the Global Acoustic Vehicle Alerting Systems Market Industry. Manufacturers are increasingly focusing on developing customizable and context-sensitive sound profiles that enhance the auditory experience for pedestrians while ensuring compliance with safety regulations. Advanced sound synthesis techniques allow for the creation of unique alerts that can vary based on vehicle speed and environment. This technological evolution not only improves safety but also offers manufacturers a competitive edge in the market. As the industry embraces these advancements, the demand for sophisticated alert systems is likely to surge, contributing to the anticipated market growth and reinforcing the importance of sound design in vehicle safety.

Consumer Awareness and Demand for Safety Features

Growing consumer awareness regarding road safety is a crucial driver for the Global Acoustic Vehicle Alerting Systems Market Industry. As public consciousness about pedestrian safety increases, consumers are more inclined to prioritize vehicles equipped with advanced safety features, including acoustic alert systems. This shift in consumer preference is prompting automotive manufacturers to enhance their offerings, thereby driving market growth. Surveys indicate that a significant percentage of potential car buyers consider pedestrian alert systems as a vital feature when purchasing vehicles. This rising demand is expected to propel the market forward, aligning with the projected growth trajectory as manufacturers respond to consumer expectations for enhanced safety.