Growing Awareness of Pedestrian Safety

There is a rising awareness regarding pedestrian safety in the United States, which is significantly impacting the acoustic vehicle-alerting-systems market. Advocacy groups and public campaigns are increasingly highlighting the risks faced by pedestrians, particularly in urban settings. This heightened awareness is prompting consumers and manufacturers alike to prioritize safety features in vehicles. As a result, the demand for acoustic alerting systems is likely to increase, as they play a vital role in preventing accidents. The market is expected to see a surge in adoption rates, with projections indicating a growth of approximately 20% in the next few years as stakeholders respond to public concerns and regulatory pressures.

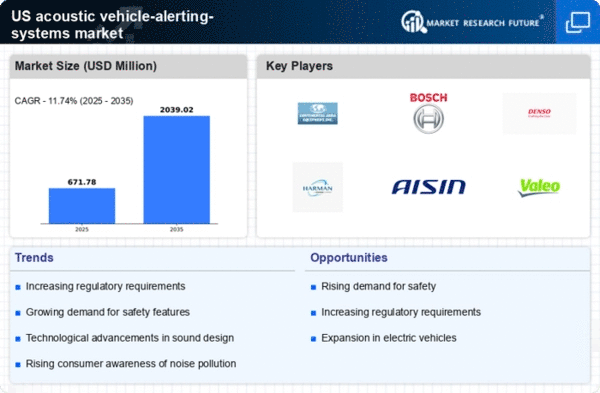

Legislative Mandates for Enhanced Safety

Legislative actions in the United States are increasingly mandating the implementation of acoustic vehicle-alerting-systems market technologies, particularly for electric and hybrid vehicles. The NHTSA has proposed regulations requiring these vehicles to emit sounds at low speeds to ensure pedestrian safety. This regulatory push is likely to create a substantial market opportunity, as manufacturers must comply with these requirements to avoid penalties. The estimated market size for these systems is projected to reach $1 billion by 2027, driven by compliance with safety standards. As such, the acoustic vehicle-alerting-systems market is poised for growth, as automakers invest in developing and integrating these systems into their vehicle designs to meet legislative expectations.

Increased Urbanization and Traffic Density

The ongoing trend of urbanization in the United States is contributing to heightened traffic density, which in turn drives the demand for acoustic vehicle-alerting-systems market. As cities expand and populations grow, the number of vehicles on the road increases, leading to a greater need for safety measures. The National Highway Traffic Safety Administration (NHTSA) indicates that pedestrian fatalities have risen, emphasizing the necessity for systems that alert pedestrians to the presence of vehicles. This urban environment creates a pressing requirement for effective alerting systems, as they can significantly reduce accidents and enhance safety for vulnerable road users. The acoustic vehicle-alerting-systems market is thus positioned to benefit from this trend, as manufacturers and regulators seek solutions to mitigate risks associated with increased vehicular presence in densely populated areas.

Consumer Demand for Enhanced Vehicle Features

The acoustic vehicle-alerting-systems market is also being driven by consumer demand for enhanced vehicle features that prioritize safety and convenience. As consumers become more informed about vehicle technologies, they increasingly seek out features that improve their driving experience and ensure safety for all road users. This trend is particularly evident among younger consumers who value innovative technologies. Manufacturers are responding by integrating advanced acoustic systems into their vehicles, which not only comply with safety regulations but also appeal to consumer preferences. The market is projected to grow as automakers invest in research and development to create more sophisticated alerting systems that meet the evolving expectations of consumers.

Technological Integration with Autonomous Vehicles

The rise of autonomous vehicles in the United States is influencing the acoustic vehicle-alerting-systems market significantly. As self-driving technology advances, the need for effective communication between vehicles and pedestrians becomes paramount. Acoustic alerting systems serve as a crucial interface, providing audible signals to inform pedestrians of an approaching vehicle. This integration is not only essential for safety but also enhances the user experience by fostering trust in autonomous technologies. The market for these systems is expected to expand as manufacturers recognize the importance of incorporating sound design into their autonomous vehicle frameworks, potentially leading to a market growth rate of 15% annually over the next five years.

Leave a Comment