Stringent Safety Regulations

The Hydrocarbon Gas Analyzer System Market is also driven by stringent safety regulations imposed by various authorities. Industries such as petrochemicals, pharmaceuticals, and food processing are required to adhere to strict safety standards to prevent hazardous incidents. Hydrocarbon gas analyzers play a vital role in ensuring compliance with these regulations by providing accurate measurements of gas concentrations. As regulatory bodies continue to enforce these standards, the demand for reliable gas analysis systems is expected to increase. This regulatory landscape is likely to contribute to a steady growth rate of around 6% in the Hydrocarbon Gas Analyzer System Market.

Rising Oil and Gas Exploration Activities

The Hydrocarbon Gas Analyzer System Market is significantly influenced by the increasing exploration and production activities in the oil and gas sector. As companies seek to optimize extraction processes and ensure safety, the demand for hydrocarbon gas analyzers is likely to rise. These systems are essential for monitoring gas composition and detecting leaks, thereby enhancing operational safety and efficiency. The oil and gas industry is projected to invest heavily in advanced monitoring technologies, which could lead to a market growth of approximately 5% over the next few years. This trend underscores the critical importance of hydrocarbon gas analyzers in supporting exploration activities.

Technological Innovations in Gas Analysis

Technological advancements are a key driver in the Hydrocarbon Gas Analyzer System Market. Innovations such as enhanced sensor technologies and data analytics capabilities are improving the accuracy and efficiency of gas analysis. For instance, the integration of artificial intelligence and machine learning algorithms into gas analyzers allows for predictive maintenance and real-time monitoring. This not only enhances operational efficiency but also reduces downtime, which is crucial for industries reliant on continuous gas monitoring. The market is expected to witness a growth rate of around 7% annually, driven by these technological innovations that are reshaping the landscape of gas analysis.

Growing Adoption in Industrial Applications

The Hydrocarbon Gas Analyzer System Market is witnessing a growing adoption of gas analyzers across various industrial applications. Industries such as manufacturing, energy, and waste management are increasingly utilizing these systems to monitor gas emissions and improve operational efficiency. The ability to provide real-time data on gas concentrations allows companies to make informed decisions regarding process optimization and emissions control. As industries strive for sustainability and efficiency, the market for hydrocarbon gas analyzers is projected to grow at a rate of approximately 5% annually. This trend highlights the expanding role of gas analyzers in diverse industrial sectors.

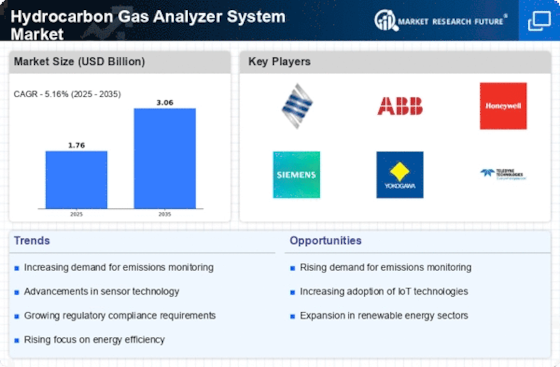

Increasing Demand for Environmental Monitoring

The Hydrocarbon Gas Analyzer System Market is experiencing a surge in demand due to heightened awareness regarding environmental protection. Governments and organizations are increasingly focusing on monitoring emissions to comply with environmental regulations. This trend is likely to drive the adoption of hydrocarbon gas analyzers, as they provide accurate and real-time data on gas emissions. The market is projected to grow at a compound annual growth rate of approximately 6% over the next five years, reflecting the critical role these systems play in environmental monitoring. As industries strive to minimize their carbon footprint, the Hydrocarbon Gas Analyzer System Market is poised for significant expansion.