Growth in Construction Activities

The growth in construction activities is a significant driver for the Hydraulics Pneumatics and Actuator Market. As urbanization accelerates and infrastructure projects expand, the demand for hydraulic and pneumatic systems in construction equipment is surging. These systems are essential for operating machinery such as excavators, cranes, and loaders, which are integral to construction operations. Recent reports indicate that the construction industry is expected to grow at a rate of 4% annually, leading to increased investments in hydraulic and pneumatic technologies. This growth trajectory suggests a robust future for the Hydraulics Pneumatics and Actuator Market as it aligns with the rising needs of the construction sector.

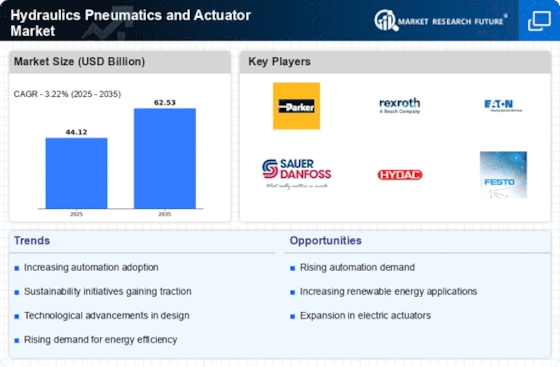

Rising Demand for Energy Efficiency

The Hydraulics Pneumatics and Actuator Market is experiencing a notable shift towards energy-efficient solutions. As industries strive to reduce operational costs and environmental impact, the demand for hydraulic and pneumatic systems that optimize energy consumption is increasing. This trend is particularly evident in sectors such as manufacturing and construction, where energy costs constitute a significant portion of operational expenses. According to recent data, energy-efficient hydraulic systems can reduce energy consumption by up to 30%, making them an attractive option for businesses. Consequently, manufacturers are investing in innovative technologies that enhance the efficiency of hydraulic and pneumatic systems, thereby driving growth in the Hydraulics Pneumatics and Actuator Market.

Expansion of Renewable Energy Sector

The Hydraulics Pneumatics and Actuator Market is poised for growth due to the expansion of the renewable energy sector. As countries invest in wind, solar, and hydroelectric power, the need for reliable hydraulic and pneumatic systems becomes increasingly critical. These systems play a vital role in the operation of renewable energy facilities, such as controlling turbine movements and managing fluid power systems. The International Energy Agency has reported a significant increase in renewable energy capacity, which is expected to drive demand for hydraulic and pneumatic solutions. This trend suggests that the Hydraulics Pneumatics and Actuator Market will benefit from the ongoing transition towards sustainable energy sources.

Increasing Adoption in Automotive Sector

The automotive sector is increasingly adopting hydraulic and pneumatic systems, which is driving growth in the Hydraulics Pneumatics and Actuator Market. As vehicles become more complex, the need for efficient actuation systems is paramount. Hydraulic systems are widely used in braking, steering, and suspension systems, while pneumatic systems are employed in various applications, including airbag deployment and seat adjustments. The automotive industry is projected to witness a steady increase in production, with estimates indicating a rise in vehicle manufacturing by approximately 5% annually. This trend suggests a corresponding increase in demand for hydraulic and pneumatic solutions, further bolstering the Hydraulics Pneumatics and Actuator Market.

Technological Advancements in Automation

Technological advancements in automation are significantly influencing the Hydraulics Pneumatics and Actuator Market. The integration of advanced control systems, sensors, and IoT technologies is enhancing the performance and reliability of hydraulic and pneumatic systems. These innovations enable real-time monitoring and predictive maintenance, which can lead to reduced downtime and increased productivity. The market for industrial automation is projected to grow substantially, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is likely to propel the demand for sophisticated hydraulic and pneumatic solutions, thereby fostering expansion within the Hydraulics Pneumatics and Actuator Market.