Emergence of Smart Hydraulic Systems

The automotive hydraulics-system market is witnessing the emergence of smart hydraulic systems, which integrate advanced technologies such as IoT and AI. These systems offer enhanced monitoring and control capabilities, allowing for real-time adjustments based on driving conditions. As the automotive industry increasingly embraces digital transformation, the demand for smart hydraulic solutions is expected to rise. By 2025, the market for smart hydraulic systems is projected to grow by approximately 10%, driven by the need for improved efficiency and performance. The automotive hydraulics-system market is thus likely to evolve, focusing on innovative solutions that leverage technology to enhance vehicle functionality.

Growth in Electric Vehicle Production

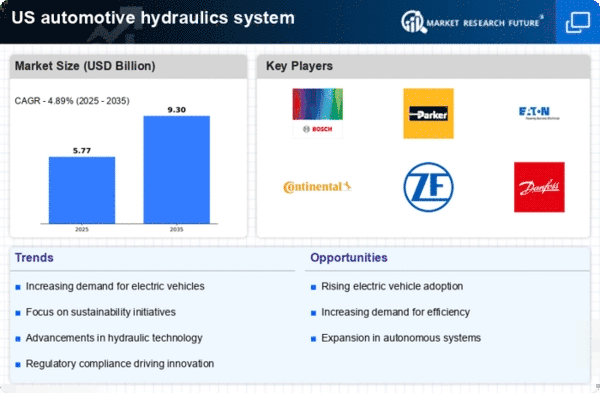

The automotive hydraulics-system market is poised for growth as the production of electric vehicles (EVs) accelerates. EV manufacturers are increasingly incorporating hydraulic systems for various applications, including braking and suspension. The market for EVs in the US is expected to reach over 3 million units by 2025, representing a substantial increase from previous years. This shift towards electrification necessitates the adaptation of hydraulic systems to meet the unique requirements of EVs, such as weight reduction and efficiency. Consequently, the automotive hydraulics-system market is likely to evolve, focusing on innovative solutions that cater to the specific needs of electric vehicles.

Increased Focus on Vehicle Performance

The automotive hydraulics-system market is significantly influenced by the growing consumer focus on vehicle performance. As drivers seek enhanced handling and responsiveness, manufacturers are investing in advanced hydraulic technologies that improve overall vehicle dynamics. This trend is evident in the rising popularity of performance-oriented vehicles, which often feature sophisticated hydraulic systems for better control and stability. In 2025, the performance vehicle segment is projected to account for a substantial share of the automotive market, further driving demand for hydraulic systems. Thus, the automotive hydraulics-system market is likely to see innovations aimed at optimizing performance, catering to the evolving preferences of consumers.

Rising Demand for Advanced Safety Features

The automotive hydraulics-system market experiences a notable surge in demand due to the increasing emphasis on advanced safety features in vehicles. As consumers prioritize safety, manufacturers are integrating hydraulic systems that enhance braking and steering capabilities. This trend is reflected in the market, where the adoption of anti-lock braking systems (ABS) and electronic stability control (ESC) is on the rise. In 2025, the market for these systems is projected to grow by approximately 8% annually, driven by consumer preferences and regulatory pressures. Thus, the automotive hydraulics-system market is positioned to benefit from this shift, as hydraulic technologies play a crucial role in ensuring vehicle safety and performance.

Expansion of Automotive Manufacturing Facilities

The automotive hydraulics-system market benefits from the expansion of manufacturing facilities across the US. As automakers invest in new plants and upgrade existing ones, there is a corresponding increase in the demand for hydraulic systems to support production processes. This trend is particularly evident in the Midwest, where several manufacturers are establishing new facilities to enhance production capabilities. The investment in automation and advanced manufacturing technologies is expected to drive the market for hydraulic systems, as these systems are integral to various manufacturing operations. The automotive hydraulics-system market is thus likely to experience growth as manufacturers seek to optimize efficiency and productivity.