North America : Market Leader in Hydraulic Services

North America is poised to maintain its leadership in the Hydraulic Systems Repair and Maintenance market, holding a significant market share of 12.5 in 2024. The region's growth is driven by robust industrial activities, increasing demand for efficient hydraulic systems, and stringent regulatory standards promoting safety and efficiency. The presence of advanced technologies and a skilled workforce further catalyze market expansion.

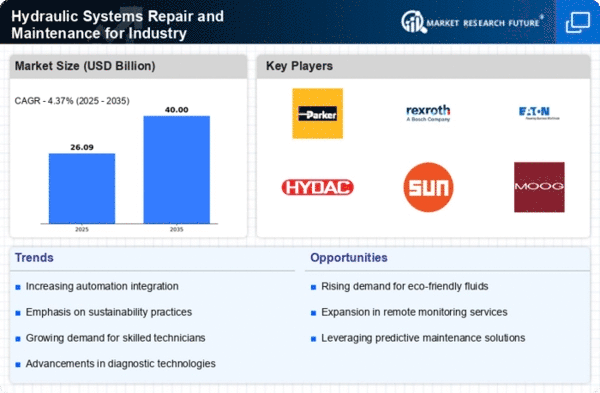

The United States stands out as the leading country, hosting major players like Parker Hannifin, Eaton, and Moog Inc. The competitive landscape is characterized by innovation and strategic partnerships among key players. The market is also supported by government initiatives aimed at enhancing industrial productivity and sustainability, ensuring a favorable environment for growth.

Europe : Innovation and Sustainability Focus

Europe's Hydraulic Systems Repair and Maintenance market is projected to grow, with a market size of 7.5 in 2024. The region's growth is fueled by increasing investments in infrastructure, a shift towards sustainable practices, and the adoption of advanced hydraulic technologies. Regulatory frameworks emphasizing environmental sustainability and safety standards are also significant drivers of market demand, encouraging companies to innovate and improve service offerings.

Germany and France are key players in this market, with a strong presence of companies like Bosch Rexroth and Hydac International. The competitive landscape is marked by a focus on R&D and collaboration among industry leaders to enhance service efficiency. As the market evolves, companies are increasingly aligning their strategies with regulatory requirements to capture emerging opportunities.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing rapid growth in the Hydraulic Systems Repair and Maintenance market, with a market size of 4.5 in 2024. This growth is driven by industrialization, urbanization, and increasing demand for hydraulic systems across various sectors. Government initiatives aimed at boosting manufacturing and infrastructure development are also contributing to market expansion, creating a favorable environment for service providers.

China and India are leading countries in this region, with a growing number of local and international players entering the market. The competitive landscape is evolving, with companies focusing on enhancing service quality and expanding their service networks. As the market matures, the emphasis on compliance with international standards and regulations will become increasingly important for sustaining growth.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region represents an emerging market for Hydraulic Systems Repair and Maintenance, with a market size of 0.5 in 2024. The growth potential is driven by increasing industrial activities, particularly in oil and gas, construction, and manufacturing sectors. Government investments in infrastructure and industrial development are expected to catalyze market growth, creating opportunities for service providers in the region.

Countries like the UAE and South Africa are at the forefront of this market, with a growing number of local and international companies establishing a presence. The competitive landscape is characterized by a mix of established players and new entrants, focusing on service quality and customer satisfaction. As the market develops, adherence to regulatory standards will be crucial for long-term success.