North America : Market Leader in MRO Services

North America is poised to maintain its leadership in the Hydraulic Shovels and Diggers MRO Services Market, holding a significant market size of $5.25 billion. The region's growth is driven by robust infrastructure investments, technological advancements, and a strong focus on maintenance and repair services. Regulatory support for sustainable practices further enhances market demand, ensuring compliance with environmental standards.

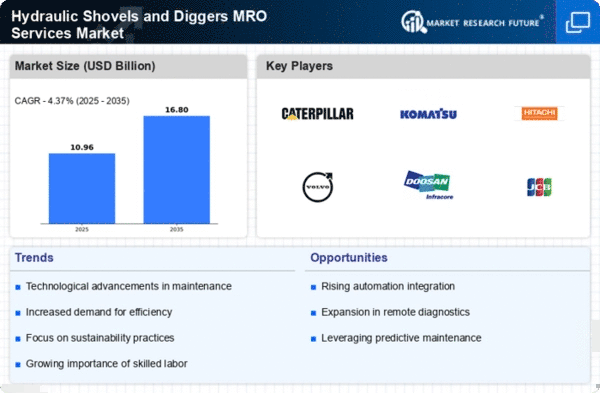

The competitive landscape is characterized by key players such as Caterpillar Inc, Komatsu Ltd, and Volvo Construction Equipment, which dominate the market. The U.S. and Canada are the leading countries, benefiting from a well-established supply chain and advanced technological capabilities. The presence of major manufacturers and service providers fosters innovation and enhances service delivery, solidifying North America's position as a market leader.

Europe : Emerging Market with Growth Potential

Europe's Hydraulic Shovels and Diggers MRO Services Market is valued at $2.8 billion, reflecting a growing demand driven by infrastructure projects and a shift towards sustainable construction practices. Regulatory frameworks promoting eco-friendly technologies and efficient resource management are key catalysts for market growth. The region is witnessing increased investments in modernization and maintenance, which are essential for enhancing operational efficiency.

Leading countries such as Germany, France, and the UK are at the forefront of this market, with a competitive landscape featuring major players like Liebherr Group and JCB. The presence of established manufacturers and a focus on innovation contribute to a dynamic market environment. As Europe continues to prioritize infrastructure development, the MRO services sector is expected to expand significantly, supported by favorable regulations and technological advancements.

Asia-Pacific : Rapidly Growing Market Dynamics

The Asia-Pacific region, with a market size of $2.0 billion, is experiencing rapid growth in the Hydraulic Shovels and Diggers MRO Services Market. This growth is fueled by increasing urbanization, infrastructure development, and rising demand for efficient machinery maintenance. Countries like China and India are investing heavily in construction and mining sectors, driving the need for advanced MRO services. Regulatory initiatives aimed at improving safety and operational standards further support market expansion.

China and Japan are the leading countries in this region, with significant contributions from local and international players such as Hitachi Construction Machinery and Doosan Infracore. The competitive landscape is evolving, with a focus on technological advancements and service innovation. As the region continues to develop, the MRO services market is expected to thrive, supported by strong demand and regulatory backing.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region, with a market size of $0.45 billion, is gradually emerging in the Hydraulic Shovels and Diggers MRO Services Market. The growth is primarily driven by increasing investments in infrastructure and construction projects, particularly in countries like the UAE and South Africa. However, challenges such as political instability and economic fluctuations can impact market dynamics. Regulatory frameworks are evolving to support sustainable practices, which may enhance market prospects in the long term.

Key players in this region include Terex Corporation and CASE Construction Equipment, which are working to establish a stronger presence. The competitive landscape is still developing, with local companies also entering the market. As the region focuses on infrastructure development, the MRO services sector is expected to grow, albeit at a slower pace compared to other regions, due to existing challenges.