North America : Market Leader in MRO Services

North America is poised to maintain its leadership in the Industrial Hydraulic Equipment MRO Services Market, holding a significant market share of 10.5 in 2024. The region's growth is driven by robust industrial activities, increasing automation, and stringent safety regulations that necessitate regular maintenance and repair services. The demand for advanced hydraulic systems in sectors like manufacturing and construction further fuels this growth, supported by government initiatives promoting infrastructure development.

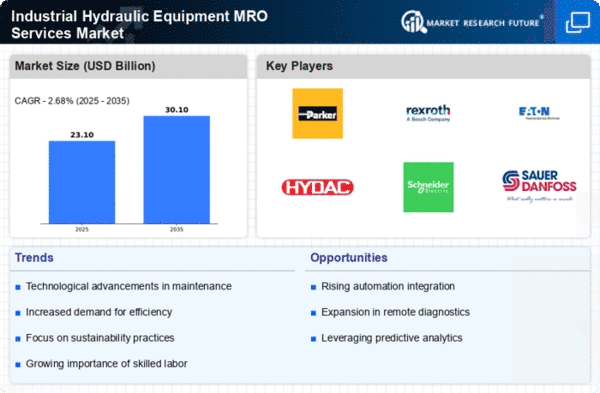

The competitive landscape in North America is characterized by the presence of key players such as Parker Hannifin, Eaton, and Moog Inc., which are investing in innovative solutions to enhance service efficiency. The U.S. stands out as the leading country, with a well-established network of service providers and a strong focus on technological advancements. This competitive environment is expected to drive further growth in the MRO services sector, ensuring that North America remains at the forefront of the industry.

Europe : Emerging Hub for Innovation

Europe is witnessing a significant transformation in the Industrial Hydraulic Equipment MRO Services Market, with a market size of 6.75 in 2024. The region's growth is propelled by increasing investments in renewable energy and automation technologies, alongside stringent environmental regulations that mandate efficient equipment maintenance. Countries like Germany and France are leading this charge, focusing on sustainable practices and innovative solutions to enhance operational efficiency.

The competitive landscape in Europe is marked by key players such as Bosch Rexroth and Hydac International, which are leveraging advanced technologies to meet the evolving demands of the market. Germany, in particular, is a powerhouse in hydraulic technology, fostering a strong ecosystem of manufacturers and service providers. The European market is expected to continue its upward trajectory, driven by a commitment to innovation and sustainability in hydraulic services.

Asia-Pacific : Rapid Growth and Development

Asia-Pacific is rapidly emerging as a key player in the Industrial Hydraulic Equipment MRO Services Market, with a market size of 4.5 in 2024. The region's growth is driven by industrialization, urbanization, and increasing demand for advanced hydraulic systems in sectors such as construction and manufacturing. Countries like China and India are at the forefront, investing heavily in infrastructure projects that require reliable hydraulic equipment maintenance and repair services.

The competitive landscape in Asia-Pacific is evolving, with both local and international players vying for market share. Companies like Kawasaki Heavy Industries are expanding their presence, focusing on innovative solutions tailored to regional needs. The growing emphasis on efficiency and reliability in hydraulic systems is expected to propel the MRO services market further, making Asia-Pacific a vital region for future growth.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is gradually emerging in the Industrial Hydraulic Equipment MRO Services Market, with a market size of 0.75 in 2024. The growth is primarily driven by increasing industrial activities and infrastructure development projects across the region. Countries like the UAE and South Africa are investing in hydraulic systems to support their expanding industrial sectors, creating a demand for efficient maintenance and repair services.

The competitive landscape in this region is still developing, with a mix of local and international players entering the market. The presence of key players is limited, but there is significant potential for growth as industries seek to enhance operational efficiency. As the region continues to invest in infrastructure and industrialization, the MRO services market is expected to gain momentum, presenting opportunities for both existing and new entrants.