North America : Market Leader in MRO Services

North America is poised to maintain its leadership in the Marine Hydraulic Systems MRO Services market, holding a significant market share of 1.25 billion in 2024. The region's growth is driven by increasing maritime activities, stringent safety regulations, and advancements in hydraulic technologies. The demand for efficient and reliable hydraulic systems is further fueled by the expansion of the shipping and offshore industries, which are critical to the economy.

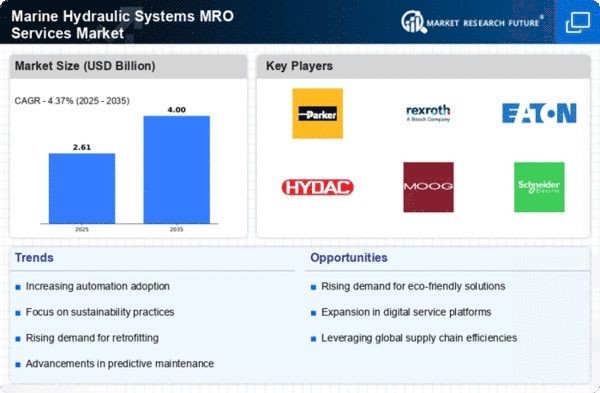

The competitive landscape in North America is robust, featuring key players such as Parker Hannifin, Eaton Corporation, and Moog Inc. These companies are leveraging innovative technologies and strategic partnerships to enhance service offerings. The U.S. stands out as the leading country, supported by a strong regulatory framework that promotes safety and efficiency in marine operations. This environment fosters continuous investment in MRO services, ensuring sustained growth in the sector.

Europe : Emerging Hub for Innovation

Europe is witnessing a growing demand for Marine Hydraulic Systems MRO Services, with a market size of 0.75 billion in 2024. The region benefits from a strong maritime heritage, advanced engineering capabilities, and a focus on sustainability. Regulatory frameworks, such as the EU's Marine Equipment Directive, are driving innovation and compliance, encouraging investments in modern hydraulic systems and maintenance services.

Leading countries in Europe include Germany, France, and the UK, where companies like Bosch Rexroth and Hydac International are prominent. The competitive landscape is characterized by a mix of established players and emerging startups, all striving to meet the evolving needs of the maritime sector. The emphasis on reducing environmental impact and enhancing operational efficiency is shaping the future of MRO services in this region.

Asia-Pacific : Rapidly Growing Market Potential

Asia-Pacific is emerging as a significant player in the Marine Hydraulic Systems MRO Services market, with a market size of 0.4 billion in 2024. The region's growth is driven by increasing shipping activities, urbanization, and investments in maritime infrastructure. Countries like China and Japan are leading the charge, supported by government initiatives aimed at enhancing maritime safety and efficiency, which are crucial for economic development.

The competitive landscape features key players such as Kawasaki Heavy Industries and Danfoss, who are focusing on technological advancements and service diversification. The presence of a large number of shipyards and a growing fleet of vessels further bolster the demand for MRO services. As the region continues to develop, the focus on quality and reliability in hydraulic systems will be paramount for sustaining growth in this sector.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region is at the nascent stage of developing its Marine Hydraulic Systems MRO Services market, with a market size of 0.1 billion in 2024. The growth potential is significant, driven by increasing maritime trade and investments in port infrastructure. However, challenges such as regulatory hurdles and limited technological adoption may hinder rapid growth. Governments are beginning to recognize the importance of enhancing maritime capabilities, which could lead to favorable policies in the future.

Countries like the UAE and South Africa are key players in this region, with a growing number of local and international companies entering the market. The competitive landscape is evolving, with firms focusing on establishing partnerships and enhancing service offerings. As the region's maritime sector matures, the demand for reliable MRO services is expected to rise, presenting opportunities for growth.