Rising Demand for Automation

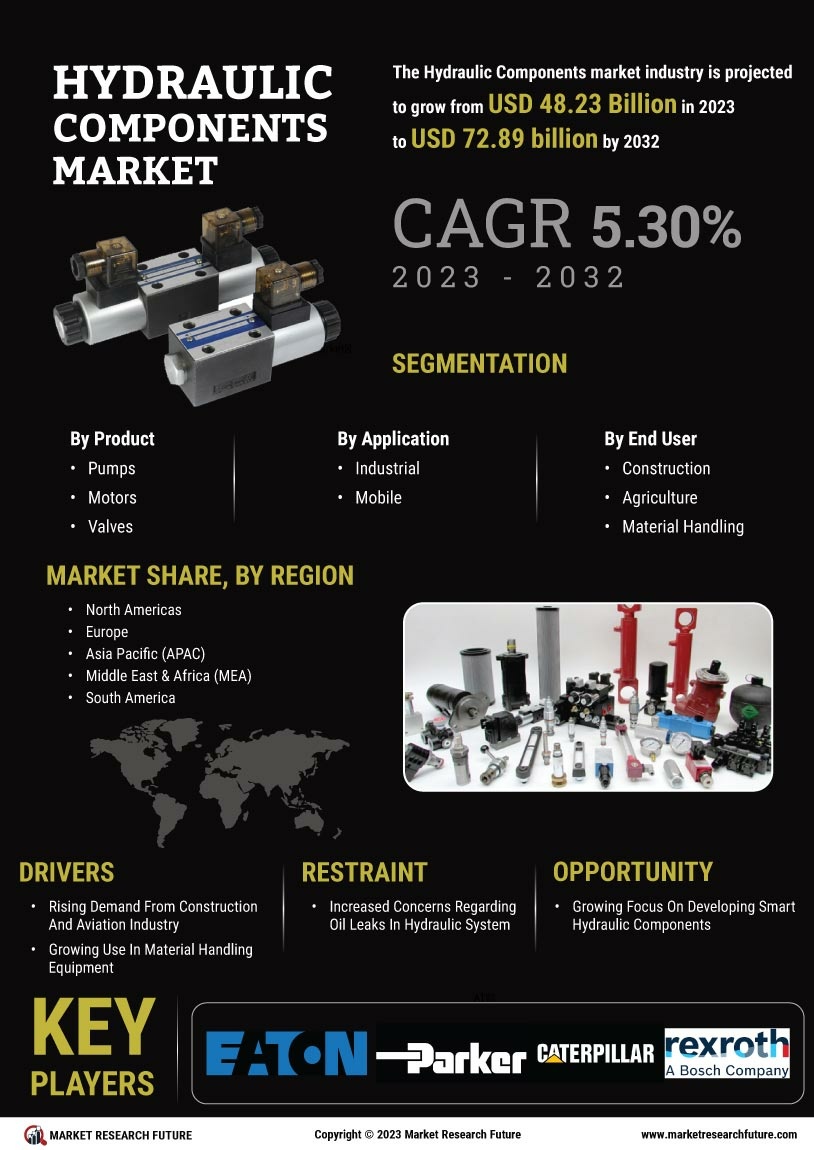

The increasing demand for automation across various industries is a primary driver of the Global Hydraulic Components Market Industry. Automation enhances efficiency and productivity, leading to a greater reliance on hydraulic systems in manufacturing, construction, and agriculture. For instance, automated machinery often utilizes hydraulic components for precise control and power transmission. This trend is expected to contribute to the market's growth, with projections indicating that the market could reach 53.5 USD Billion in 2024. As industries continue to adopt automation technologies, the demand for hydraulic components is likely to rise, further solidifying their role in modern industrial applications.

Growth in Renewable Energy Sector

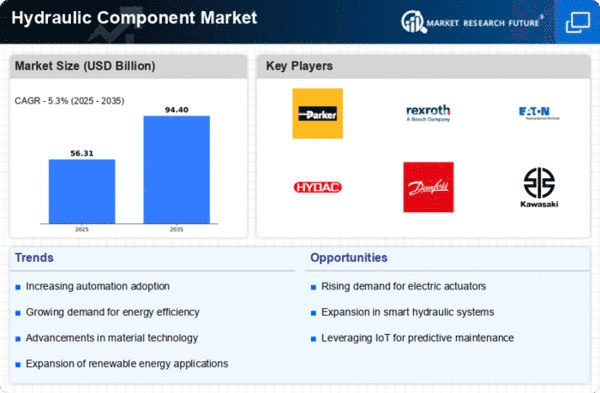

The shift towards renewable energy sources is emerging as a significant driver for the Global Hydraulic Components Market Industry. Hydraulic systems are increasingly utilized in renewable energy applications, such as wind turbines and hydroelectric power plants. These systems provide essential functions, including power generation and control mechanisms. The global push for sustainable energy solutions is likely to enhance the demand for hydraulic components, as they are integral to the efficient operation of renewable energy systems. This trend may contribute to a compound annual growth rate of 5.3% from 2025 to 2035, reflecting the growing importance of hydraulic technology in the energy sector.

Infrastructure Development Initiatives

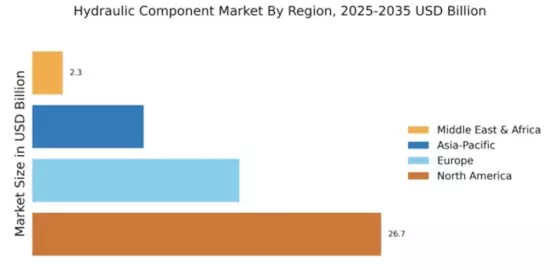

Infrastructure development initiatives globally are significantly influencing the Global Hydraulic Components Market Industry. Governments are investing heavily in infrastructure projects, including transportation, energy, and urban development. These projects often require hydraulic systems for construction equipment, such as excavators and cranes, which rely on hydraulic components for operation. For example, the expansion of road networks and public transportation systems necessitates the use of hydraulic machinery. As these initiatives progress, the market is anticipated to grow, potentially reaching 94.4 USD Billion by 2035, driven by the sustained demand for hydraulic components in large-scale infrastructure projects.

Technological Advancements in Hydraulic Systems

Technological advancements in hydraulic systems are driving innovation within the Global Hydraulic Components Market Industry. Developments such as smart hydraulic systems, IoT integration, and enhanced materials are improving the performance and reliability of hydraulic components. These advancements enable more efficient energy use and reduced maintenance costs, appealing to industries seeking to optimize operations. For instance, the integration of sensors and automation in hydraulic systems allows for real-time monitoring and control, enhancing productivity. As these technologies continue to evolve, they are expected to stimulate market growth, aligning with the increasing demand for high-performance hydraulic solutions.

Chart: Global Hydraulic Components Market Growth

This chart illustrates the projected growth trajectory of the Global Hydraulic Components Market Industry from 2024 to 2035. The market is expected to reach 53.5 USD Billion in 2024, with a significant increase to 94.4 USD Billion by 2035. The compound annual growth rate during the period from 2025 to 2035 is projected to be 5.3%, indicating a robust expansion driven by various factors, including automation, infrastructure development, and technological advancements.