Hybrid Memory Cube High-Bandwidth Memory Market Summary

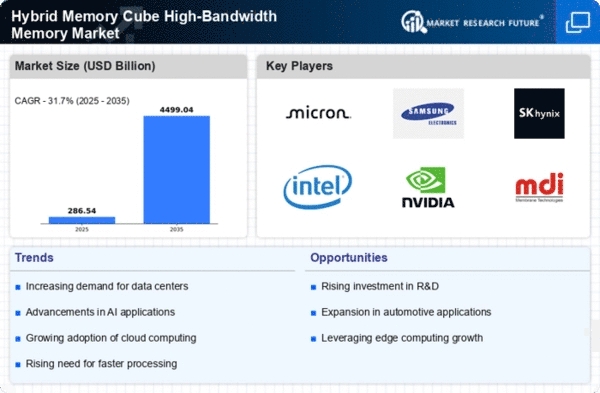

As per MRFR analysis, the Hybrid Memory Cube High-Bandwidth Memory Market Size was estimated at 217.57 USD Billion in 2024. The Hybrid Memory Cube High-Bandwidth Memory industry is projected to grow from 286.55 USD Billion in 2025 to 4499.04 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 31.7% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Hybrid Memory Cube High-Bandwidth Memory Market is poised for substantial growth driven by technological advancements and increasing demand across various sectors.

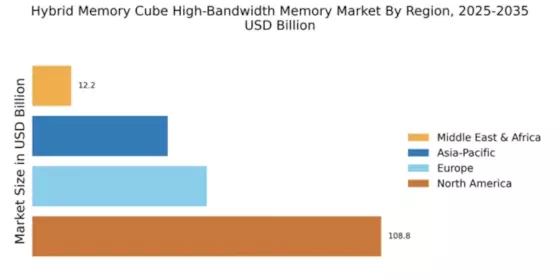

- The market experiences rising demand for high-performance computing, particularly in North America, which remains the largest market.

- Asia-Pacific emerges as the fastest-growing region, fueled by the rapid expansion of cloud computing and IoT applications.

- The data center segment continues to dominate, while the artificial intelligence segment shows the fastest growth trajectory in the market.

- Key market drivers include advancements in artificial intelligence and the increasing need for enhanced gaming experiences, which are shaping the industry's future.

Market Size & Forecast

| 2024 Market Size | 217.57 (USD Billion) |

| 2035 Market Size | 4499.04 (USD Billion) |

| CAGR (2025 - 2035) | 31.7% |

Major Players

Micron Technology (US), Samsung Electronics (KR), SK Hynix (KR), Intel Corporation (US), NVIDIA Corporation (US), Advanced Micro Devices (US), Broadcom Inc. (US), Texas Instruments (US)