Hybrid Integration Platform Size

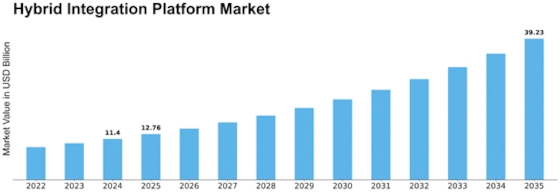

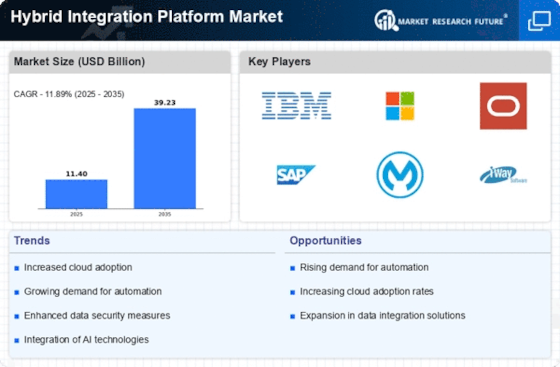

Hybrid Integration Platform Market Growth Projections and Opportunities

Key variables shape the Hybrid Integration Platform (HIP) market's growth and development. Growing company desire in consistent integration arrangements drives the market. Coordinating different systems and apps is becoming more important as companies try to increase functional competency and nimbleness. Hybrid Integration Platforms solve on-premises and cloud concerns and provide effective communication between applications and data sources.

Another key driver of the HIP business is distributed computing's quick multiplication. With enterprises adopting cloud-based services for agility, robust integration arrangements are essential. HIPs let organizations to seamlessly integrate their on-premises infrastructure with cloud apps and services, ensuring a robust IT biological system. The growing popularity of hybrid and multi-cloud systems, where companies use public and private cloud resources, highlights this trend.

Security and administrative consistency also shape the Hybrid Integration Platform industry. Security and consistency of integrated systems become a top priority for companies handling sensitive data. HIPs solve these concerns by incorporating advanced security and consistency features, ensuring safe information transfer and capacity. In industries including finance, healthcare, and government, strict administrative requirements necessitate extensive integration.

The HIP market is impacted by the constantly evolving mechanical scene. The rise of IoT, artificial reasoning, and blockchain has created a complex IT environment that requires improved integration. Hybrid Integration Platforms, which can connect and coordinate multiple technologies, are essential for understanding modern IT systems.

Hybrid Integration Platforms' popularity also depends on cost. Companies are always looking for smart solutions that integrate fully without wasting money. HIPs reduce integration time, improvement time, and custom coding, making them cost-effective. This cost-viability convinces companies to cut IT budgets while maintaining network consistency.

Market rivalry and vendor scenario promote Hybrid Integration Platforms. The growing number of arrangement suppliers and the variety of contributions create a serious atmosphere that encourages growth and drives HIP functional improvements. Associations evaluate merchants based on adaptability, convenience, and support for new innovations, influencing market trends and HIP arrangements.

Leave a Comment