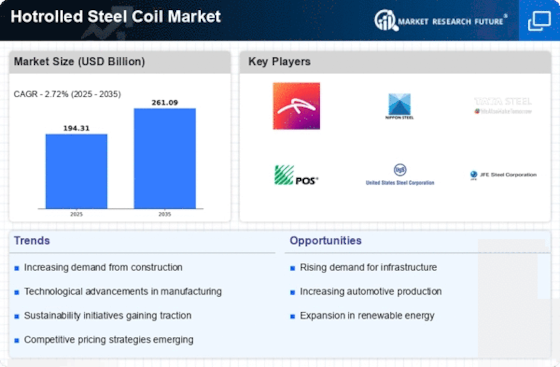

Energy Sector Investments

Investments in the energy sector, particularly in renewable energy projects, are poised to drive the Hotrolled Steel Coil Market. The construction of wind farms, solar power plants, and other renewable energy infrastructures necessitates the use of hotrolled steel coils for various applications, including structural components and support systems. In 2025, it is estimated that the energy sector will represent approximately 15% of the total demand for hotrolled steel. This trend suggests a growing recognition of the importance of sustainable energy solutions, which could further bolster the Hotrolled Steel Coil Market as companies seek to align with environmental goals.

Automotive Industry Demand

The automotive sector's recovery and growth are likely to significantly influence the Hotrolled Steel Coil Market. As vehicle manufacturers increasingly focus on producing lightweight and fuel-efficient vehicles, the demand for hotrolled steel coils is expected to rise. In 2025, the automotive industry is anticipated to account for around 25% of the total hotrolled steel consumption. This trend may be attributed to the shift towards electric vehicles, which require advanced materials for structural integrity and weight reduction. Consequently, the Hotrolled Steel Coil Market could see a robust increase in demand as automotive manufacturers seek high-quality steel products to meet evolving consumer preferences.

Infrastructure Development

The ongoing expansion of infrastructure projects appears to be a primary driver for the Hotrolled Steel Coil Market. Governments and private sectors are investing heavily in roads, bridges, and buildings, which necessitate substantial quantities of hotrolled steel coils. For instance, in 2025, the construction sector is projected to consume approximately 30% of the total hotrolled steel production. This demand is likely to be fueled by urbanization trends and the need for modernized facilities, which could further stimulate the market. As infrastructure projects continue to proliferate, the Hotrolled Steel Coil Market is expected to experience sustained growth, driven by the essential role of steel in construction.

Trade Policies and Tariffs

The influence of trade policies and tariffs on the Hotrolled Steel Coil Market cannot be overlooked. Changes in import and export regulations can significantly impact the availability and pricing of hotrolled steel coils. In 2025, it is anticipated that trade policies will continue to evolve, potentially affecting market dynamics. For instance, tariffs on imported steel may lead to increased domestic production, thereby influencing supply chains and pricing strategies. This environment could create both challenges and opportunities for the Hotrolled Steel Coil Market, as stakeholders navigate the complexities of international trade.

Manufacturing Sector Growth

The resurgence of the manufacturing sector is likely to be a significant driver for the Hotrolled Steel Coil Market. As economies recover and production ramps up, the demand for raw materials, including hotrolled steel coils, is expected to increase. In 2025, the manufacturing industry is projected to consume about 20% of the total hotrolled steel output. This growth may be attributed to advancements in manufacturing technologies and increased production capacities. As manufacturers seek to optimize their operations, the Hotrolled Steel Coil Market could benefit from heightened demand for high-quality steel products that meet stringent industry standards.