Increasing Vehicle Production

The Automotive Coil Spring Market is experiencing growth due to the rising production of vehicles across various segments. As manufacturers ramp up production to meet consumer demand, the need for high-quality coil springs becomes paramount. In 2025, the automotive sector is projected to produce over 90 million vehicles, which directly correlates with the demand for coil springs. This increase in vehicle production not only drives the need for coil springs but also encourages innovation in design and materials. Manufacturers are likely to invest in advanced coil spring technologies to enhance performance and durability, thereby contributing to the overall growth of the Automotive Coil Spring Market.

Expansion of Aftermarket Services

The expansion of aftermarket services is emerging as a key driver for the Automotive Coil Spring Market. As vehicle ownership rates rise, the demand for replacement parts, including coil springs, is expected to increase. The aftermarket segment is projected to grow significantly, with estimates suggesting a market size of over 100 billion by 2026. This growth is attributed to the increasing awareness among consumers regarding vehicle maintenance and the importance of using quality replacement parts. Consequently, the Automotive Coil Spring Market is likely to benefit from this trend, as manufacturers and suppliers focus on providing high-quality coil springs that meet the needs of the aftermarket segment.

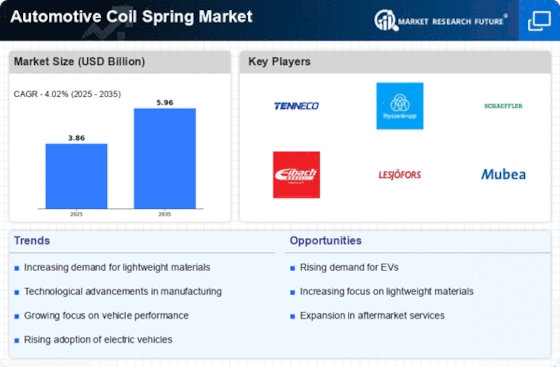

Rising Demand for Electric Vehicles

The shift towards electric vehicles (EVs) is significantly impacting the Automotive Coil Spring Market. As more consumers opt for EVs, manufacturers are adapting their designs to accommodate the unique requirements of these vehicles. Electric vehicles often require specialized coil springs to support their weight and enhance ride quality. The EV market is expected to grow at a compound annual growth rate of over 20% in the coming years, which will likely increase the demand for innovative coil spring solutions. This trend indicates a potential shift in the Automotive Coil Spring Market, as manufacturers may need to develop lighter and more efficient coil springs to meet the evolving needs of the electric vehicle segment.

Technological Advancements in Manufacturing

Technological advancements in manufacturing processes are playing a crucial role in shaping the Automotive Coil Spring Market. Innovations such as automated production lines and advanced materials are enhancing the efficiency and quality of coil spring production. For instance, the adoption of computer-aided design (CAD) and computer-aided manufacturing (CAM) technologies allows for precise engineering of coil springs, resulting in improved performance and longevity. As manufacturers embrace these technologies, the Automotive Coil Spring Market is likely to witness a surge in high-performance products that meet stringent safety and quality standards. This trend not only benefits manufacturers but also enhances consumer satisfaction with superior vehicle performance.

Growing Focus on Vehicle Safety and Performance

The increasing emphasis on vehicle safety and performance is a significant driver for the Automotive Coil Spring Market. As regulatory standards become more stringent, manufacturers are compelled to enhance the safety features of their vehicles, including suspension systems. Coil springs play a vital role in ensuring vehicle stability and handling, which are critical for safety. In 2025, it is anticipated that the automotive industry will allocate substantial resources to improve safety features, thereby increasing the demand for high-quality coil springs. This focus on safety and performance is likely to propel the Automotive Coil Spring Market forward, as manufacturers seek to provide reliable and efficient suspension solutions.