Rising Operational Costs

Rising operational costs in healthcare are driving the adoption of Hospital Management Software HM Market solutions. As hospitals face increasing expenses related to staffing, equipment, and technology, there is a pressing need for software that enhances operational efficiency and reduces costs. Reports indicate that hospitals can save up to 30% in operational costs by implementing comprehensive management software that streamlines processes such as billing, inventory management, and patient scheduling. This financial incentive is prompting healthcare organizations to invest in advanced Hospital Management Software HM Market solutions that not only improve efficiency but also contribute to overall cost reduction.

Focus on Patient-Centric Care

The shift towards patient-centric care is significantly influencing the Hospital Management Software HM Market. Healthcare providers are increasingly prioritizing patient engagement and satisfaction, which necessitates the implementation of software solutions that enhance the patient experience. Features such as appointment scheduling, real-time health monitoring, and personalized communication are becoming essential components of hospital management systems. Data suggests that hospitals that adopt patient-centric approaches can see a 20% increase in patient satisfaction scores. This trend indicates that the Hospital Management Software HM Market must evolve to meet the expectations of both patients and providers, fostering a more collaborative healthcare environment.

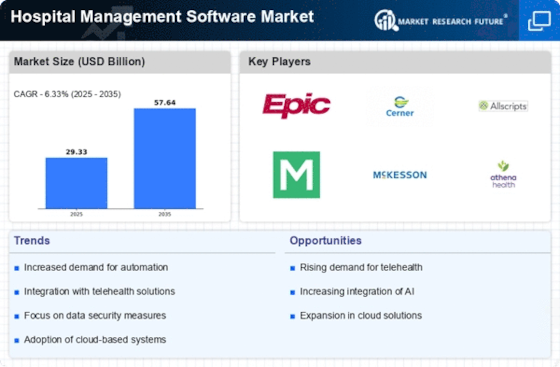

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into Hospital Management Software HM Market is emerging as a pivotal driver of growth. AI technologies are being utilized to enhance decision-making processes, optimize resource allocation, and improve patient outcomes. For instance, predictive analytics powered by AI can assist hospitals in forecasting patient admissions, thereby enabling better staffing and inventory management. Reports indicate that the AI healthcare market is projected to reach approximately 36 billion USD by 2025, underscoring the potential for AI-driven solutions within the Hospital Management Software HM Market. As healthcare providers seek to leverage data for improved operational efficiency, the demand for AI-integrated software solutions is likely to escalate.

Regulatory Compliance and Data Security

Regulatory compliance and data security remain critical drivers within the Hospital Management Software HM Market. As healthcare regulations become increasingly stringent, hospitals are compelled to adopt software solutions that ensure compliance with laws such as HIPAA and GDPR. The financial implications of non-compliance can be severe, with penalties reaching millions of dollars. Furthermore, the rise in cyber threats necessitates robust data security measures to protect sensitive patient information. The Hospital Management Software HM Market is thus witnessing a surge in demand for solutions that not only facilitate compliance but also enhance data security protocols, ensuring the integrity and confidentiality of patient data.

Increased Demand for Telehealth Services

The rise in telehealth services has catalyzed a transformation within the Hospital Management Software HM Market. As healthcare providers increasingly adopt remote consultation methods, the need for integrated software solutions that facilitate virtual visits has surged. This trend is evidenced by a reported increase in telehealth usage, with estimates suggesting that over 70% of healthcare organizations are now utilizing some form of telehealth technology. Consequently, Hospital Management Software HM Market must adapt to incorporate features that support telehealth functionalities, ensuring seamless communication between patients and providers. This shift not only enhances patient access to care but also streamlines administrative processes, thereby improving overall operational efficiency.