Increased Urban Farming

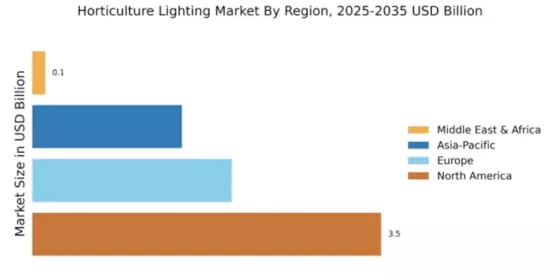

Urban farming is gaining traction globally, driven by the need for sustainable food production in densely populated areas. The Global Horticulture Lighting Market Industry is poised to benefit from this trend, as urban farms often rely on artificial lighting to maximize crop yields in limited spaces. Vertical farming, in particular, utilizes advanced horticulture lighting systems to create optimal growing conditions year-round. This shift towards urban agriculture is likely to contribute to the industry's growth, with a projected CAGR of 11.16% from 2025 to 2035, reflecting the increasing reliance on innovative lighting solutions.

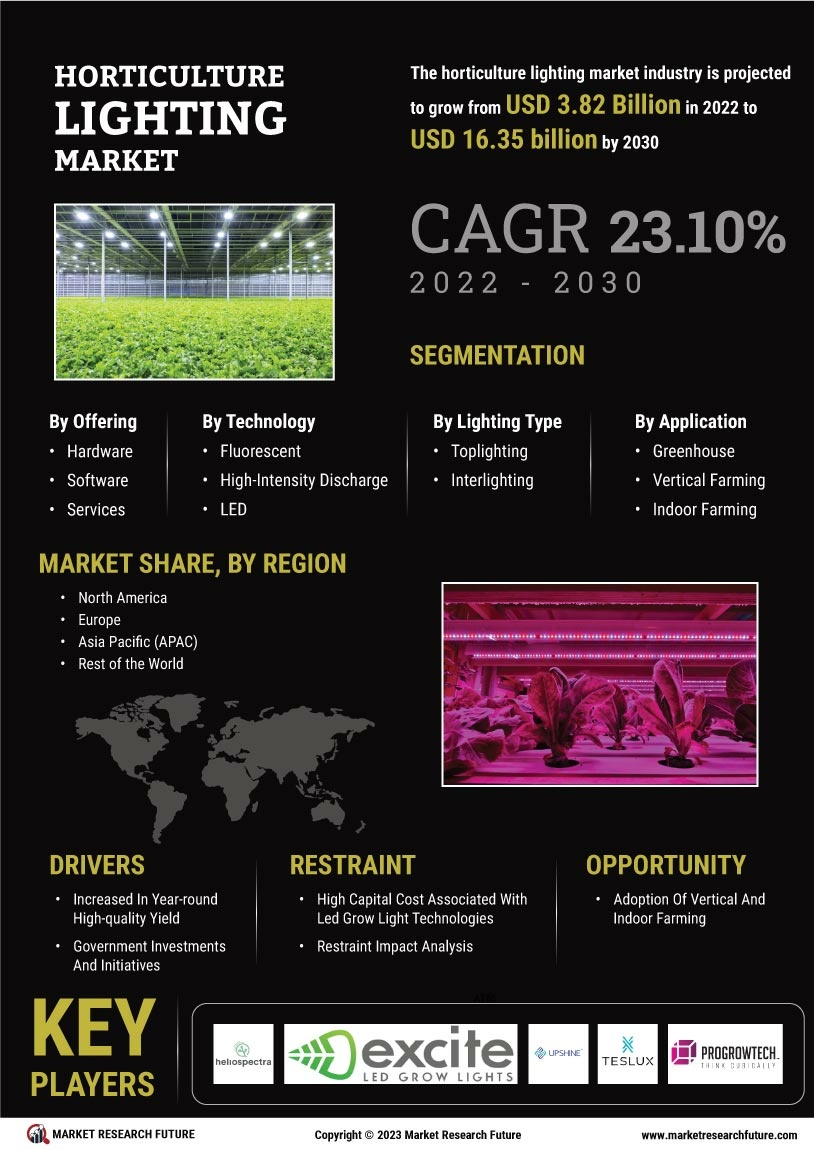

Market Growth Projections

The Global Horticulture Lighting Market Industry is on a growth trajectory, with projections indicating a market value of 2.03 USD Billion in 2024 and an anticipated increase to 6.5 USD Billion by 2035. This growth is driven by various factors, including technological advancements, urban farming trends, and rising consumer demand for organic produce. The industry is expected to experience a compound annual growth rate (CAGR) of 11.16% from 2025 to 2035, reflecting the increasing adoption of horticulture lighting solutions across diverse agricultural sectors. These projections underscore the industry's potential to transform agricultural practices and enhance food production globally.

Technological Advancements

The Global Horticulture Lighting Market Industry is experiencing rapid technological advancements, particularly in LED lighting solutions. These innovations enhance energy efficiency and reduce operational costs, making them increasingly attractive to growers. For instance, the introduction of full-spectrum LED lights allows for tailored light wavelengths that optimize plant growth. As a result, growers can achieve higher yields and better quality produce. This trend is reflected in the projected market growth, with the industry expected to reach 2.03 USD Billion in 2024 and potentially 6.5 USD Billion by 2035, indicating a robust demand for advanced lighting technologies.

Climate Change and Food Security

The challenges posed by climate change are prompting a reevaluation of agricultural practices, particularly in regions vulnerable to extreme weather. The Global Horticulture Lighting Market Industry is likely to play a crucial role in addressing food security concerns by enabling controlled environment agriculture. Horticulture lighting systems allow for year-round production, mitigating the impacts of climate variability. As growers seek reliable solutions to ensure consistent food supply, the demand for advanced lighting technologies is expected to rise. This trend aligns with the projected CAGR of 11.16% from 2025 to 2035, highlighting the industry's potential in enhancing food security.

Rising Demand for Organic Produce

Consumer preferences are shifting towards organic produce, which is often cultivated under controlled environments utilizing horticulture lighting. The Global Horticulture Lighting Market Industry is responding to this demand by providing lighting solutions that support organic farming practices. Growers are increasingly adopting advanced lighting technologies to ensure consistent quality and yield of organic crops. This trend is likely to drive market growth, as the industry adapts to meet the needs of environmentally conscious consumers. The anticipated growth trajectory, with the market expected to reach 6.5 USD Billion by 2035, underscores the importance of horticulture lighting in organic agriculture.

Government Support and Regulations

Government initiatives aimed at promoting sustainable agriculture are influencing the Global Horticulture Lighting Market Industry. Various countries are implementing regulations and providing incentives for the adoption of energy-efficient lighting solutions in agriculture. These policies encourage growers to invest in advanced horticulture lighting technologies, thereby enhancing productivity and sustainability. For example, subsidies for LED lighting systems are becoming more common, facilitating access for small and medium-sized farms. This supportive regulatory environment is expected to contribute to the industry's growth, with a projected market value of 2.03 USD Billion in 2024, indicating a favorable landscape for horticulture lighting.