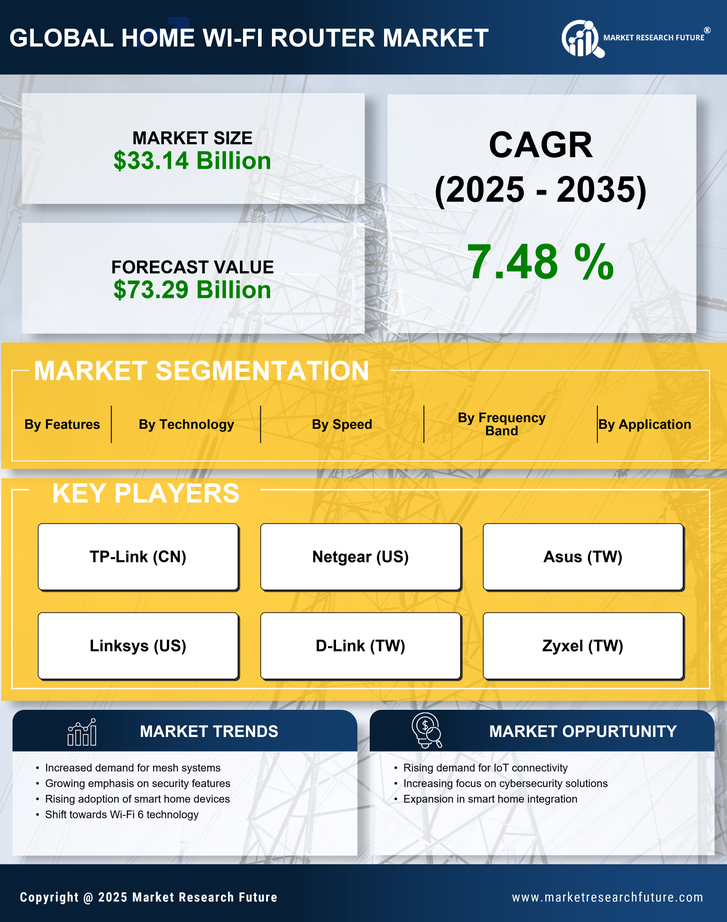

Rising Internet Usage

The increasing reliance on the internet for various activities, such as remote work, online education, and streaming services, drives the Home Wi-fi Router Market. As of October 2025, it is estimated that over 80% of households utilize internet services, necessitating robust home networking solutions. This surge in internet usage has led to a heightened demand for high-performance routers capable of supporting multiple devices simultaneously. Consequently, manufacturers are innovating to provide routers that can handle increased bandwidth and connectivity needs. The Home Wi-fi Router Market is thus experiencing a significant transformation, with consumers seeking devices that offer not only speed but also reliability and coverage. This trend indicates a potential for sustained growth in the market as more households prioritize seamless internet access.

Advancements in Technology

Technological advancements play a pivotal role in shaping the Home Wi-fi Router Market. The introduction of Wi-Fi 6 and upcoming Wi-Fi 7 standards promises enhanced speed, capacity, and efficiency, catering to the growing number of connected devices in homes. As of October 2025, the market is witnessing a shift towards routers that incorporate advanced features such as mesh networking, which provides extensive coverage and eliminates dead zones. These innovations are not merely incremental; they represent a fundamental change in how consumers interact with their home networks. The Home Wi-fi Router Market is thus positioned for growth, as consumers increasingly seek routers that leverage cutting-edge technology to improve their online experiences. This trend suggests that manufacturers who invest in research and development may gain a competitive edge in this evolving landscape.

Growth of Smart Home Devices

The proliferation of smart home devices significantly influences the Home Wi-fi Router Market. As households increasingly adopt smart technologies, the demand for routers that can efficiently manage multiple connected devices rises. By October 2025, it is estimated that over 50% of homes will have at least one smart device, necessitating routers that can handle the increased traffic and provide stable connections. This trend compels manufacturers to develop routers with enhanced capabilities, such as Quality of Service (QoS) features that prioritize bandwidth for critical applications. The Home Wi-fi Router Market is thus evolving to meet the needs of consumers who seek seamless integration of their smart devices with their home networks. This growth trajectory suggests that the market will continue to expand as more consumers embrace smart home technologies.

Evolving Consumer Preferences

Consumer preferences are shifting towards more user-friendly and aesthetically pleasing home networking solutions, impacting the Home Wi-fi Router Market. As of October 2025, there is a noticeable trend where consumers favor routers that not only perform well but also blend seamlessly with home decor. This evolution in consumer taste is prompting manufacturers to design routers that are not only functional but also visually appealing. Additionally, the demand for easy installation and management features is on the rise, with many consumers seeking routers that can be set up and controlled via mobile applications. This shift in preferences indicates that the Home Wi-fi Router Market must adapt to meet the changing expectations of consumers, potentially leading to innovative designs and user-centric features that enhance the overall user experience.

Increased Focus on Cybersecurity

As cyber threats become more sophisticated, the emphasis on cybersecurity within the Home Wi-fi Router Market intensifies. Consumers are increasingly aware of the vulnerabilities associated with unsecured networks, prompting a demand for routers equipped with advanced security features. By October 2025, it is projected that nearly 60% of consumers prioritize security when selecting a router, leading manufacturers to integrate features such as automatic firmware updates, built-in firewalls, and advanced encryption protocols. This heightened focus on security not only enhances consumer confidence but also drives innovation within the market. The Home Wi-fi Router Market is thus adapting to these demands, with companies striving to offer products that ensure safe and secure internet access for users. This trend indicates a potential shift in consumer purchasing behavior, favoring brands that prioritize security in their offerings.