Market Growth Projections

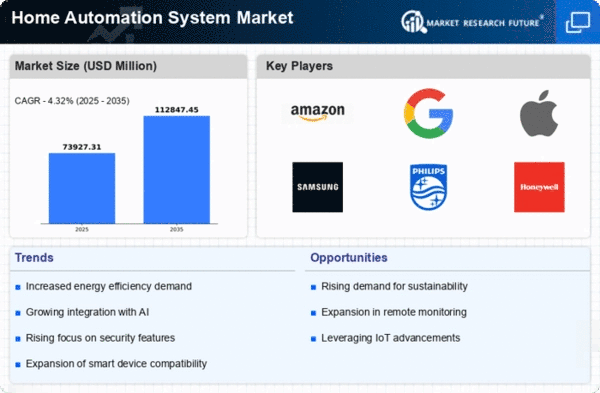

The Global Home Automation System Market Industry is poised for substantial growth, with projections indicating a market value of 70.9 USD Billion in 2024 and an anticipated increase to 112.2 USD Billion by 2035. This growth trajectory suggests a robust demand for home automation solutions driven by various factors, including technological advancements and changing consumer preferences. The market is expected to experience a compound annual growth rate (CAGR) of 4.27% from 2025 to 2035, reflecting the increasing integration of smart technologies in residential settings. These projections underscore the potential for innovation and expansion within the home automation sector, indicating a promising future for industry stakeholders.

Consumer Awareness and Adoption

Consumer awareness regarding the benefits of home automation systems significantly impacts the Global Home Automation System Market Industry. As information about smart home technologies becomes more accessible, consumers are increasingly inclined to adopt these systems. Educational campaigns and marketing efforts by manufacturers highlight the advantages of automation, such as convenience, energy savings, and enhanced security. This growing awareness is reflected in the rising sales of smart home devices, indicating a shift in consumer behavior. As more households embrace automation, the market is poised for growth, suggesting that consumer education will continue to play a pivotal role in shaping industry trends.

Increased Focus on Home Security

The Global Home Automation System Market Industry is significantly influenced by the heightened focus on home security. Consumers are increasingly concerned about safety, leading to a surge in demand for smart security systems. These systems often include features such as surveillance cameras, motion detectors, and smart locks, which can be monitored remotely via smartphones. The convenience of managing home security from anywhere enhances consumer appeal. As crime rates fluctuate globally, the desire for enhanced security measures appears to drive market growth. This trend is likely to contribute to the overall market expansion, with a projected CAGR of 4.27% from 2025 to 2035, indicating sustained interest in home security solutions.

Technological Advancements in IoT

Technological advancements in the Internet of Things (IoT) significantly drive the Global Home Automation System Market Industry. The integration of IoT technology enables seamless communication between devices, enhancing user experience and functionality. Smart home devices, such as security cameras, smart locks, and voice assistants, are increasingly interconnected, allowing for remote monitoring and control. This interconnectedness not only improves convenience but also enhances security and efficiency. As IoT technology continues to evolve, the market is expected to expand, with projections indicating a growth to 112.2 USD Billion by 2035. The potential for innovation in home automation systems remains vast, suggesting a dynamic future for the industry.

Rising Demand for Energy Efficiency

The Global Home Automation System Market Industry experiences a notable surge in demand for energy-efficient solutions. Homeowners increasingly seek systems that optimize energy consumption, thereby reducing utility bills and environmental impact. For instance, smart thermostats and automated lighting systems allow users to manage energy use effectively. This trend aligns with the broader global initiative to combat climate change, as energy-efficient homes contribute to lower carbon footprints. The market is projected to reach 70.9 USD Billion in 2024, reflecting a growing awareness of sustainability among consumers. As energy costs rise, the adoption of home automation systems that enhance energy efficiency is likely to accelerate.

Growing Urbanization and Smart Cities

Urbanization plays a crucial role in shaping the Global Home Automation System Market Industry. As more individuals move to urban areas, the demand for smart homes and automation solutions increases. Urban environments often face challenges such as congestion and energy inefficiency, prompting the development of smart city initiatives. Home automation systems are integral to these initiatives, as they promote energy conservation and enhance living standards. The integration of smart technologies in urban planning suggests a future where homes are equipped with advanced automation systems. This trend is likely to drive market growth, aligning with the global shift towards sustainable urban living and smart city development.

Leave a Comment