Growth in Automotive Applications

The automotive industry is increasingly adopting high temperature fibers for various applications, including insulation, gaskets, and heat shields. As vehicles become more sophisticated, the need for materials that can endure high temperatures while maintaining structural integrity is paramount. The High Temperature Fiber Market is likely to benefit from this trend, with projections suggesting that the automotive segment could witness a compound annual growth rate of over 5% in the coming years. This growth is driven by the rising demand for electric vehicles, which require advanced materials to manage heat effectively. Consequently, high temperature fibers are becoming a preferred choice for automotive manufacturers aiming to enhance performance and safety.

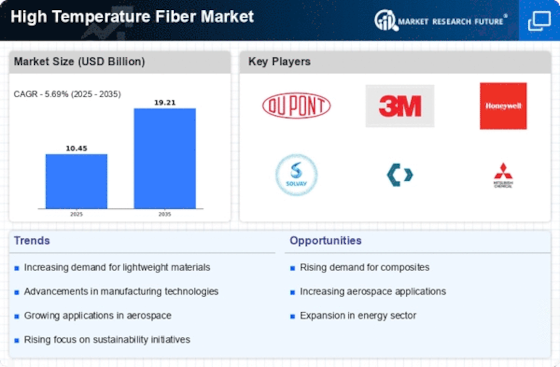

Rising Demand in Aerospace Sector

The aerospace sector is experiencing a notable increase in demand for high temperature fibers, primarily due to their lightweight and heat-resistant properties. These fibers are essential in manufacturing components that can withstand extreme temperatures, such as engine parts and thermal protection systems. The High Temperature Fiber Market is projected to grow as aerospace manufacturers seek materials that enhance fuel efficiency and reduce overall weight. According to recent estimates, the aerospace segment is expected to account for a significant share of the high temperature fiber market, potentially reaching a valuation of several billion dollars by 2026. This trend indicates a robust future for high temperature fibers as they become integral to advanced aerospace applications.

Expansion in Industrial Applications

High temperature fibers are finding increasing utility in various industrial applications, including manufacturing, energy, and chemical processing. These fibers are utilized in products such as protective clothing, insulation materials, and filtration systems, which are essential for maintaining safety and efficiency in high-temperature environments. The High Temperature Fiber Market is poised for growth as industries seek materials that can withstand harsh conditions while ensuring worker safety. Recent data indicates that the industrial segment is expected to grow steadily, with a projected market size reaching several hundred million dollars by 2027. This expansion reflects a broader trend towards adopting advanced materials in industrial processes.

Regulatory Support for Advanced Materials

Regulatory frameworks are increasingly supporting the use of advanced materials, including high temperature fibers, across various sectors. Governments are promoting the adoption of materials that enhance safety and efficiency, particularly in industries such as aerospace and automotive. The High Temperature Fiber Market stands to benefit from these regulatory initiatives, which may include incentives for manufacturers to utilize high-performance materials. As regulations evolve to favor sustainable and efficient solutions, the demand for high temperature fibers is expected to rise. This regulatory support could potentially lead to a market expansion, with projections indicating a favorable environment for growth in the coming years.

Technological Innovations in Fiber Production

Technological advancements in the production of high temperature fibers are significantly influencing the market landscape. Innovations such as improved manufacturing techniques and the development of new fiber compositions are enhancing the performance characteristics of these materials. The High Temperature Fiber Market is likely to see increased investment in research and development, leading to the introduction of fibers with superior heat resistance and durability. This trend is expected to attract a diverse range of industries, from aerospace to automotive, as they seek cutting-edge materials to meet their evolving needs. As a result, the market may experience a surge in demand for high temperature fibers, driven by these technological breakthroughs.