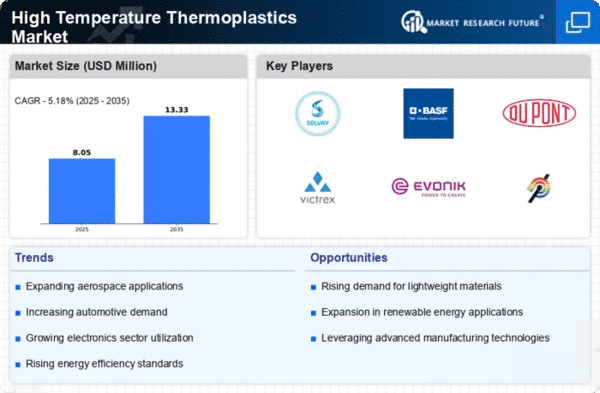

Market Growth Projections

The Global High Temperature Thermoplastics Market Industry is projected to experience substantial growth, with estimates indicating a market size of 12.5 USD Billion in 2024. The anticipated compound annual growth rate of 6.5% from 2025 to 2035 suggests a robust expansion trajectory, driven by increasing demand across various sectors. The market's growth is likely to be fueled by advancements in material technology, rising applications in aerospace and automotive industries, and a growing emphasis on sustainability. By 2035, the market could potentially reach 25 USD Billion, reflecting the evolving landscape of high temperature thermoplastics and their critical role in modern manufacturing.

Increased Focus on Sustainability

The Global High Temperature Thermoplastics Market Industry is witnessing a shift towards sustainable practices, as manufacturers seek to reduce their environmental impact. High temperature thermoplastics offer the advantage of recyclability and longevity, making them appealing for industries aiming to adopt greener materials. Companies are increasingly investing in research and development to create bio-based thermoplastics that meet high-performance standards. This focus on sustainability not only aligns with global environmental goals but also enhances the market's appeal to eco-conscious consumers. As sustainability becomes a priority, the Global High Temperature Thermoplastics Market Industry is likely to experience growth, reflecting changing consumer preferences.

Rising Demand in Aerospace Sector

The Global High Temperature Thermoplastics Market Industry experiences a notable surge in demand from the aerospace sector, which increasingly favors lightweight and heat-resistant materials. High temperature thermoplastics, such as polyether ether ketone (PEEK) and polyphenylene sulfide (PPS), are utilized in aircraft components due to their superior thermal stability and mechanical properties. The industry's projected growth to 12.5 USD Billion in 2024 is largely driven by aerospace applications, where weight reduction is critical for fuel efficiency. As the aerospace sector continues to expand, the Global High Temperature Thermoplastics Market Industry is likely to witness sustained growth, potentially doubling to 25 USD Billion by 2035.

Advancements in Automotive Applications

The automotive industry increasingly adopts high temperature thermoplastics for components that require durability and resistance to extreme conditions. Materials like polyamide (PA) and polyetherimide (PEI) are gaining traction in automotive applications, particularly in electric vehicles where thermal management is crucial. The Global High Temperature Thermoplastics Market Industry is poised to benefit from this trend, as manufacturers seek to enhance vehicle performance while reducing weight. The anticipated compound annual growth rate of 6.5% from 2025 to 2035 indicates a robust future for these materials in automotive applications, reflecting a broader shift towards innovative materials in the automotive sector.

Technological Innovations in Material Science

The Global High Temperature Thermoplastics Market Industry benefits from ongoing technological innovations in material science, which enhance the performance and application range of thermoplastics. Recent advancements in processing techniques and material formulations have led to the development of thermoplastics with improved thermal stability and mechanical properties. These innovations enable manufacturers to explore new applications across various industries, including aerospace, automotive, and electronics. As companies continue to invest in research and development, the market is expected to expand, potentially reaching 25 USD Billion by 2035, driven by the introduction of next-generation high temperature thermoplastics.

Growth in Electronics and Electrical Applications

The Global High Temperature Thermoplastics Market Industry is significantly influenced by the electronics and electrical sectors, where materials must withstand high temperatures and provide electrical insulation. Thermoplastics such as PEEK and polyimide (PI) are increasingly utilized in connectors, insulators, and circuit boards. As electronic devices become more compact and powerful, the demand for materials that can endure elevated temperatures without compromising performance is rising. This trend is expected to contribute to the market's growth, with projections indicating a market size of 12.5 USD Billion in 2024, driven by the need for reliable and durable components in the electronics industry.