Growing Focus on Lightweight Components

The High Temperature 3D Printing Plastic Market is witnessing a growing focus on lightweight components, particularly in the aerospace and automotive sectors. The demand for lightweight materials is driven by the need to improve fuel efficiency and reduce emissions. High-temperature 3D printing plastics offer an attractive solution, as they can be engineered to provide strength while minimizing weight. According to recent studies, the use of lightweight materials can lead to a reduction in vehicle weight by up to 30%, which directly correlates with improved fuel economy. This trend is likely to propel the adoption of high-temperature plastics in manufacturing processes, thereby enhancing the market's growth prospects.

Technological Advancements in 3D Printing

Technological advancements in 3D printing are significantly influencing the High Temperature 3D Printing Plastic Market. Innovations in printing techniques, such as improved extrusion processes and enhanced material formulations, are enabling the production of more complex geometries and higher quality parts. These advancements are not only increasing the efficiency of the printing process but also expanding the range of applications for high-temperature plastics. For example, the introduction of new thermoplastic materials that can withstand temperatures exceeding 300 degrees Celsius is opening new avenues in industries like aerospace and defense. As these technologies continue to evolve, they are expected to drive market growth and attract new players into the high-temperature 3D printing sector.

Rising Demand for High-Performance Materials

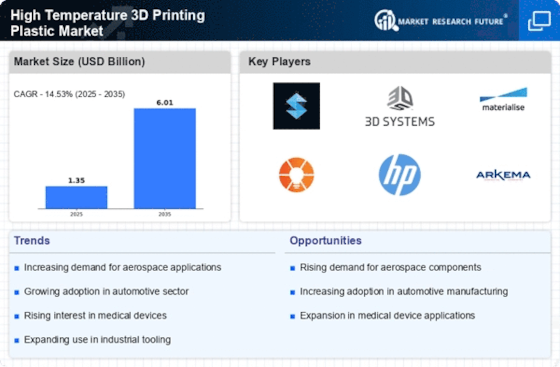

The High Temperature 3D Printing Plastic Market is experiencing a notable surge in demand for high-performance materials. Industries such as aerospace, automotive, and electronics are increasingly adopting these materials due to their superior thermal resistance and mechanical properties. For instance, the market for high-temperature plastics is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years. This growth is driven by the need for components that can withstand extreme conditions without compromising structural integrity. As manufacturers seek to enhance product performance, the adoption of high-temperature 3D printing plastics is likely to become more prevalent, thereby expanding the market further.

Regulatory Support for Advanced Manufacturing

Regulatory support for advanced manufacturing practices is playing a pivotal role in the High Temperature 3D Printing Plastic Market. Governments are increasingly recognizing the importance of additive manufacturing in driving economic growth and innovation. Initiatives aimed at promoting advanced manufacturing technologies are likely to create a favorable environment for the adoption of high-temperature 3D printing plastics. For example, policies that encourage investment in new technologies and provide funding for research projects can significantly enhance market dynamics. As regulatory frameworks evolve to support these advancements, the high-temperature 3D printing sector is expected to benefit from increased adoption and investment.

Increased Investment in Research and Development

Increased investment in research and development is a key driver for the High Temperature 3D Printing Plastic Market. Companies are allocating substantial resources to explore new materials and improve existing ones, aiming to enhance the performance characteristics of high-temperature plastics. This investment is crucial for developing innovative solutions that meet the evolving needs of various industries. For instance, research initiatives focused on bio-based high-temperature plastics are gaining traction, as they align with sustainability goals while maintaining performance standards. As R&D efforts continue to expand, they are expected to yield breakthroughs that will further stimulate market growth and diversification.