Growing Construction Activities

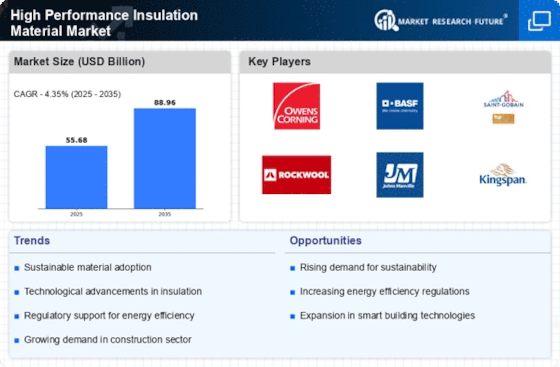

The resurgence of construction activities in both residential and commercial sectors is likely to bolster the High Performance Insulation Material Market. According to recent data, construction spending has seen a steady increase, with projections indicating a compound annual growth rate of approximately 5% over the next five years. This growth is driven by urbanization, population growth, and the need for sustainable building practices. High-performance insulation materials are increasingly being specified in new construction projects due to their ability to improve energy efficiency and reduce operational costs. Consequently, this trend is expected to create substantial opportunities for manufacturers and suppliers within the insulation market.

Rising Energy Efficiency Standards

The increasing emphasis on energy efficiency standards across various sectors appears to be a primary driver for the High Performance Insulation Material Market. Governments and regulatory bodies are implementing stringent regulations aimed at reducing energy consumption in buildings and industrial applications. For instance, the International Energy Agency has reported that energy efficiency measures could lead to a reduction in energy demand by up to 30% by 2030. This trend is likely to propel the demand for high-performance insulation materials, as they play a crucial role in meeting these standards. As a result, manufacturers are focusing on developing innovative insulation solutions that not only comply with regulations but also enhance overall building performance.

Technological Innovations in Insulation

Technological advancements in insulation materials are playing a pivotal role in shaping the High Performance Insulation Material Market. Innovations such as aerogel, vacuum insulation panels, and phase change materials are enhancing the thermal performance of insulation products. These technologies not only improve energy efficiency but also reduce the thickness and weight of insulation systems, making them more versatile for various applications. The market for advanced insulation technologies is expected to witness a growth rate of around 6% annually, driven by the demand for high-performance solutions in both new constructions and retrofitting projects. As a result, manufacturers are increasingly investing in research and development to create cutting-edge insulation materials that meet evolving market needs.

Government Incentives for Energy Efficiency

Government incentives aimed at promoting energy efficiency are likely to serve as a catalyst for the High Performance Insulation Material Market. Various countries are offering tax credits, rebates, and grants to encourage the adoption of energy-efficient building practices. These incentives not only lower the initial costs associated with high-performance insulation materials but also enhance their appeal to consumers and businesses. For example, programs that support energy-efficient retrofitting of existing buildings are gaining popularity, leading to increased demand for advanced insulation solutions. As these initiatives continue to evolve, they are expected to significantly impact the market dynamics, fostering a more favorable environment for high-performance insulation materials.

Increased Awareness of Environmental Impact

There is a growing awareness regarding the environmental impact of construction materials, which appears to be influencing the High Performance Insulation Material Market. Consumers and businesses are becoming more conscious of their carbon footprints and are seeking sustainable alternatives. High-performance insulation materials, often made from recycled or eco-friendly components, are gaining traction as they contribute to lower greenhouse gas emissions. Reports suggest that the market for sustainable insulation materials is projected to grow significantly, with an estimated increase of 8% annually. This shift towards environmentally responsible choices is likely to drive demand for high-performance insulation solutions, as they align with the broader sustainability goals of various stakeholders.

.png)