Research Methodology on Building Insulation Material Market

RESEARCH OBJECTIVE

- To analyze the global Building Insulation Material Market

- To study the current trends and future prospects of the Building Insulation Material Market

- To research the segmentation of the Building Insulation Material Market

- To investigate the driving factors and industry barriers for the Building Insulation Material Market

- To assess the competitive dynamics of the Building Insulation Material Market

RESEARCH SCOPE

This study aims to review the latest trends, drivers, and technology of the global Building Insulation Material Market over the forecast period from 2023 to 2030. The report further provides a comprehensive analysis of the industry with key market segments and sub-segments, and trends, and offers insights into the building insulation material market.

RESEARCH METHODOLOGY

Research Type

The research conducted to analyze the Building Insulation Material Market is qualitative and quantitative in nature. The qualitative research involved analyzing the existing market reports, articles, and white papers, while the quantitative research involved market segmentation, forecasting, statistical analysis, and market estimation (using secondary and primary data).

Primary Data

Primary data was collected from various seminars, interviews, discussions, surveys, and datasets conducted with industry leaders, professionals, and distributors. It was observed that the primary data collected from interviews was more reliable and accurate than the secondary and quantitative data gathered from sources such as reports and surveys.

Secondary Data

Secondary data were obtained from different sources such as government websites, corporate websites, portals, and press releases. This enabled the research team to better understand the products, services, and techniques used in the Building Insulation Material Market.

Data Analysis

Data were analyzed using multiple methods, including descriptive and explanatory analysis techniques. Further, graphical formats such as tables, charts, and diagrams were used for the visual presentation of the data.

MARKET SEGMENTATION

The Building Insulation Material Market is segmented based on product, type, application, and region.

By Product

The Building Insulation Material Market is segmented into two categories based on the types of products available in the market, namely rigid and flexible insulations. These materials are categorized according to their end-use applications.

- a) Rigid Insulations – These include glass wool, calcium silicate, expanded polystyrene, extruded polystyrene, polyurethane, and rock wool.

- b) Flexible Insulations – These include foil, fibreglass, and cellulose.

By Type

The Building Insulation Material Market is segmented into four different types, namely, airborne, thermal, water-repellent, and air-permeable.

- a) Airborne – These materials are designed to reduce sound transmission and can be either rigid or flexible.

- b) Thermal – These are materials used to reduce heat loss or gain by resisting the flow of energy.

- c) Water-repellent – This type of insulation is used to prevent the passage of moisture.

- d) Air-permeable – This type of insulation is designed to allow air to pass through the material.

By Application

The Building Insulation Material Market is segmented into various end-use applications, such as commercial, industrial, residential, and others.

- a) Commercial – These products are used in commercial buildings, such as office buildings, shopping centres, and hotels.

- b) Industrial – These materials are used in warehouses, manufacturing plants, and refineries.

- c) Residential – These products are used in residential homes.

- d) Others – This includes products used for other applications such as automotive and military.

By Region

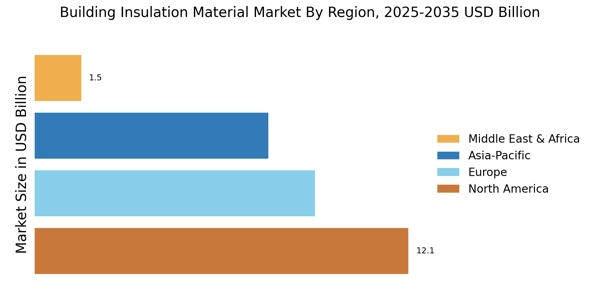

The Building Insulation Material Market is segmented based on geographical regions, such as North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

KEY MARKET PLAYERS

The ke y market players in the Building Insulation Material Market include Owens Corning (US), Dupont (US), Johns Manville (US), PPG Industries (US), Rockwool (Denmark), Kingspan (Ireland), Armacell (Luxembourg), SABIC (Saudi Arabia), Polymer Technologies (US), and Stouder Industries (US).

CONCLUSION

The Building Insulation Material Market is expected to register a positive CAGR over the forecast period from 2023 to 2030, owing to the increasing demand for energy-efficient products in various sectors, such as commercial, industrial, and residential. Moreover, the rising awareness of green buildings and sustainable architecture is anticipated to propel the demand for building insulation materials during the forecast period. The development of advanced insulation materials is further expected to propel the growth of the Building Insulation Material Market during the forecast period.