Advancements in Hardware Technology

Technological advancements in hardware, particularly in processors and memory, are significantly influencing the High Performance Computing Software Market. The introduction of more powerful CPUs and GPUs enables HPC software to perform complex calculations at unprecedented speeds. For example, the development of multi-core processors and specialized hardware accelerators has enhanced computational capabilities, allowing for more efficient data processing. This evolution in hardware technology is expected to drive the market forward, as organizations increasingly invest in HPC solutions to leverage these advancements. Market analysts suggest that the integration of cutting-edge hardware with HPC software could lead to performance improvements of up to 50%, thereby attracting more users to the High Performance Computing Software Market.

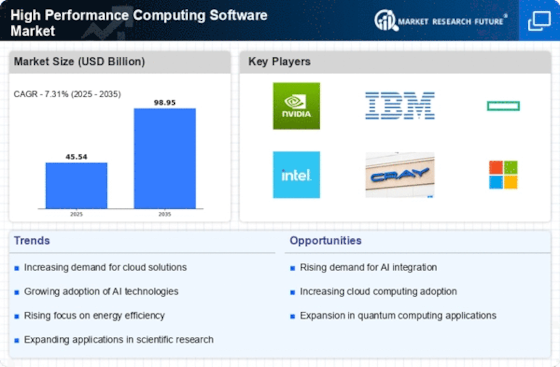

Growing Adoption of Cloud Computing

The growing adoption of cloud computing is emerging as a significant driver for the High Performance Computing Software Market. Organizations are increasingly migrating their HPC workloads to cloud platforms, which offer flexibility, scalability, and cost-effectiveness. This shift allows businesses to access powerful computing resources without the need for substantial upfront investments in infrastructure. According to industry reports, the cloud HPC market is expected to reach a valuation of several billion dollars by 2026, reflecting a strong trend towards cloud-based solutions. As more enterprises recognize the benefits of cloud HPC, the High Performance Computing Software Market is likely to expand, providing innovative solutions that cater to diverse computational needs.

Emergence of Industry-Specific Solutions

The emergence of industry-specific HPC solutions is becoming a notable driver for the High Performance Computing Software Market. As different sectors face unique challenges, there is a growing demand for tailored HPC software that addresses specific needs. For example, the energy sector requires HPC for seismic data analysis, while the automotive industry utilizes it for crash simulations. This trend indicates a shift towards more specialized solutions that enhance operational efficiency and effectiveness. Market forecasts suggest that the development of customized HPC software could lead to increased adoption rates, thereby expanding the High Performance Computing Software Market as organizations seek solutions that align closely with their operational requirements.

Increased Focus on Research and Development

An increased focus on research and development across various sectors is driving the High Performance Computing Software Market. Governments and private organizations are investing heavily in R&D to foster innovation and maintain competitive advantages. This trend is particularly evident in fields such as aerospace, automotive, and pharmaceuticals, where HPC software is utilized for simulations, modeling, and complex calculations. For instance, the aerospace industry employs HPC for aerodynamic simulations, while pharmaceuticals leverage it for drug discovery processes. The global investment in R&D is projected to grow, suggesting that the demand for HPC solutions will likely rise in tandem, further propelling the High Performance Computing Software Market.

Rising Demand for Data-Intensive Applications

The increasing reliance on data-intensive applications across various sectors appears to be a primary driver for the High Performance Computing Software Market. Industries such as finance, healthcare, and scientific research are increasingly utilizing HPC software to process vast amounts of data efficiently. For instance, the financial sector employs HPC for risk analysis and algorithmic trading, while healthcare utilizes it for genomic research and personalized medicine. According to recent estimates, the demand for data processing capabilities is projected to grow at a compound annual growth rate of over 10%, indicating a robust market for HPC solutions. This trend suggests that as organizations seek to harness the power of big data, the High Performance Computing Software Market will likely experience substantial growth.