Rising Global Meat Consumption

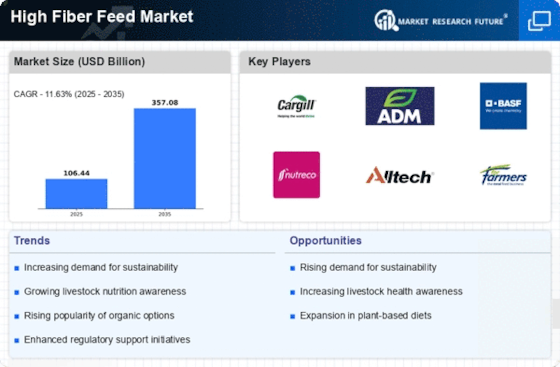

The increasing The High Fiber Feed Industry. As populations grow and dietary preferences shift towards higher meat consumption, the need for efficient livestock production systems becomes more pronounced. High fiber feed plays a vital role in enhancing the growth rates and overall health of livestock, thereby supporting the meat production industry. Current projections suggest that meat consumption could rise by 20% over the next decade, necessitating a corresponding increase in feed production. This surge in demand for meat is likely to propel the high fiber feed market, as producers seek to optimize their livestock diets to meet consumer expectations while ensuring sustainability.

Growth in Organic Farming Practices

The expansion of organic farming practices is significantly impacting the High Fiber Feed Market. As consumers increasingly demand organic products, farmers are adapting their practices to meet these preferences. High fiber feed is often a key component of organic livestock diets, as it aligns with the principles of natural and sustainable farming. Market data suggests that the organic livestock feed segment is expected to grow at a rate of 7% annually, driven by the rising consumer awareness of health and environmental issues. This growth in organic farming not only enhances the demand for high fiber feed but also encourages innovation in feed production methods, further shaping the dynamics of the High Fiber Feed Market.

Increasing Awareness of Nutritional Benefits

The rising awareness regarding the nutritional advantages of high fiber feed is a pivotal driver in the High Fiber Feed Market. Livestock producers are increasingly recognizing that high fiber diets can enhance digestive health, improve nutrient absorption, and promote overall well-being in animals. This shift in perception is supported by research indicating that high fiber feed can lead to better weight management and reduced incidences of metabolic disorders. As a result, the demand for high fiber feed is projected to grow, with estimates suggesting a compound annual growth rate of approximately 5% over the next five years. This trend reflects a broader movement towards healthier livestock management practices, which is likely to shape the future landscape of the High Fiber Feed Market.

Regulatory Support for Sustainable Practices

Regulatory frameworks promoting sustainable agricultural practices are increasingly influencing the High Fiber Feed Market. Governments are implementing policies that encourage the use of high fiber feed as a means to reduce environmental impact and enhance animal welfare. For instance, regulations aimed at decreasing greenhouse gas emissions from livestock production are likely to favor high fiber feed, which can contribute to lower methane emissions. The market is expected to respond positively to these regulatory incentives, with projections indicating a potential increase in market size by 10% over the next decade. This regulatory support not only aligns with environmental goals but also positions high fiber feed as a viable solution for sustainable livestock farming.

Technological Innovations in Feed Formulation

Technological advancements in feed formulation are revolutionizing the High Fiber Feed Market. Innovations such as precision nutrition and the use of feed additives are enabling producers to optimize the nutritional profiles of high fiber feeds. These technologies allow for the customization of feed to meet specific dietary needs of different livestock species, enhancing feed efficiency and animal performance. Market analysts indicate that the integration of technology in feed production could lead to a 15% increase in feed efficiency, thereby reducing costs for producers. This trend not only supports the economic viability of high fiber feed but also promotes its adoption across various livestock sectors, indicating a robust future for the High Fiber Feed Market.