Regulatory Support and Standards

The US Hearing Screening Diagnostic Devices Market benefits from robust regulatory support and established standards that ensure the safety and efficacy of diagnostic devices. Agencies such as the Food and Drug Administration (FDA) play a crucial role in the approval and monitoring of hearing screening technologies. Recent initiatives aimed at streamlining the approval process for innovative devices have encouraged manufacturers to invest in research and development. Furthermore, adherence to standards set by organizations like the American National Standards Institute (ANSI) ensures that devices meet quality benchmarks, fostering consumer trust. As regulatory frameworks evolve to accommodate new technologies, the US Hearing Screening Diagnostic Devices Market is poised for growth, with an increasing number of devices entering the market that comply with stringent safety and performance criteria.

Integration of Telehealth Services

The US Hearing Screening Diagnostic Devices Market is witnessing a transformative shift with the integration of telehealth services into hearing assessments. This trend has gained momentum as healthcare providers seek to enhance accessibility and convenience for patients, particularly in rural and underserved areas. Telehealth platforms enable remote hearing screenings, allowing patients to receive timely evaluations without the need for in-person visits. This approach not only reduces barriers to access but also aligns with the broader movement towards digital health solutions. As telehealth continues to gain traction, the demand for compatible hearing screening diagnostic devices is expected to rise. The US Hearing Screening Diagnostic Devices Market is likely to benefit from this integration, as it fosters innovative solutions that cater to the evolving needs of patients and healthcare providers alike.

Rising Incidence of Hearing Disorders

The US Hearing Screening Diagnostic Devices Market is significantly impacted by the rising incidence of hearing disorders across various demographics. Recent statistics indicate that approximately 48 million Americans experience some form of hearing loss, a figure that is expected to rise as the population ages. This alarming trend has prompted healthcare providers to advocate for more frequent hearing screenings, particularly among vulnerable groups such as the elderly and those with occupational noise exposure. The increasing prevalence of hearing disorders is likely to drive demand for advanced diagnostic devices, as early detection is crucial for effective management and treatment. Consequently, the US Hearing Screening Diagnostic Devices Market is anticipated to expand, with manufacturers focusing on developing innovative solutions to address the growing need for reliable hearing assessments.

Increased Focus on Preventive Healthcare

The US Hearing Screening Diagnostic Devices Market is significantly influenced by the growing emphasis on preventive healthcare measures. As awareness regarding the importance of early detection of hearing loss rises, healthcare providers are increasingly recommending routine hearing screenings. This trend is particularly evident among aging populations, where the prevalence of hearing impairment is notably high. The Centers for Disease Control and Prevention (CDC) has reported that nearly 15% of adults in the US experience some degree of hearing loss, underscoring the necessity for regular screenings. Consequently, the demand for hearing screening diagnostic devices is expected to escalate, as healthcare systems prioritize preventive strategies to mitigate the long-term impacts of untreated hearing loss. This shift towards preventive care is likely to bolster the US Hearing Screening Diagnostic Devices Market, fostering growth and innovation in device development.

Technological Advancements in Screening Devices

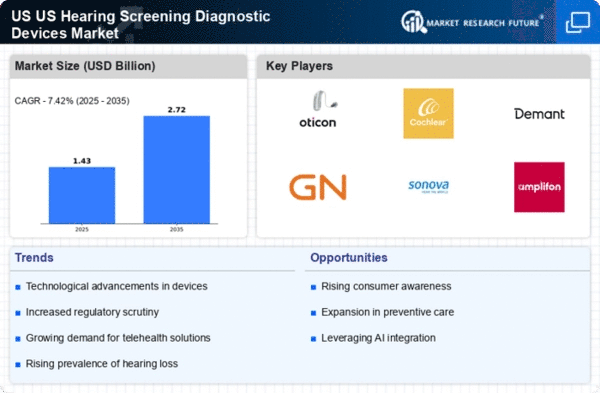

The US Hearing Screening Diagnostic Devices Market is experiencing a surge in technological advancements that enhance the accuracy and efficiency of hearing assessments. Innovations such as portable audiometers and automated screening systems are becoming increasingly prevalent. These devices not only facilitate early detection of hearing impairments but also improve patient compliance due to their user-friendly interfaces. According to recent data, the market for these advanced devices is projected to grow at a compound annual growth rate (CAGR) of approximately 7% over the next five years. This growth is driven by the integration of artificial intelligence and machine learning, which enable more precise diagnostics and personalized treatment plans. As technology continues to evolve, the US Hearing Screening Diagnostic Devices Market is likely to witness further enhancements that could redefine standard practices in hearing healthcare.