Technological Advancements in Health IT

Technological advancements play a pivotal role in shaping the Healthcare Data Interoperability Market. Innovations such as cloud computing, artificial intelligence, and blockchain technology are facilitating the development of more robust interoperability solutions. These technologies enable real-time data sharing and enhance the accuracy of health information exchange. For instance, the integration of AI in health IT systems can streamline data processing and improve decision-making capabilities. As healthcare organizations adopt these advanced technologies, the market for interoperability solutions is likely to expand significantly. The increasing complexity of healthcare data necessitates sophisticated tools that can manage and integrate diverse data sources effectively.

Growing Emphasis on Patient-Centric Care

The shift towards patient-centric care is a driving force in the Healthcare Data Interoperability Market. Healthcare providers are increasingly focusing on delivering personalized care that meets the unique needs of patients. This approach necessitates the sharing of comprehensive patient data across various platforms and systems. As a result, interoperability solutions that facilitate the exchange of patient information are becoming essential. The emphasis on patient engagement and empowerment is expected to propel the demand for interoperable systems. Market analysts suggest that the patient-centric model could lead to a 20% increase in the adoption of interoperability solutions over the next few years, underscoring the importance of data sharing in enhancing patient outcomes.

Increased Focus on Data Analytics and Insights

The growing emphasis on data analytics is reshaping the Healthcare Data Interoperability Market. Healthcare organizations are increasingly leveraging data analytics to derive actionable insights from vast amounts of health data. Interoperability solutions that facilitate data integration and analysis are becoming crucial for organizations aiming to improve clinical outcomes and operational efficiency. The ability to analyze data from multiple sources allows healthcare providers to identify trends, enhance decision-making, and optimize resource allocation. As the demand for data-driven insights continues to rise, the market for interoperability solutions is expected to grow. Analysts predict that the integration of advanced analytics capabilities into interoperability platforms could lead to a market growth of approximately 10% over the next few years.

Rising Demand for Integrated Healthcare Systems

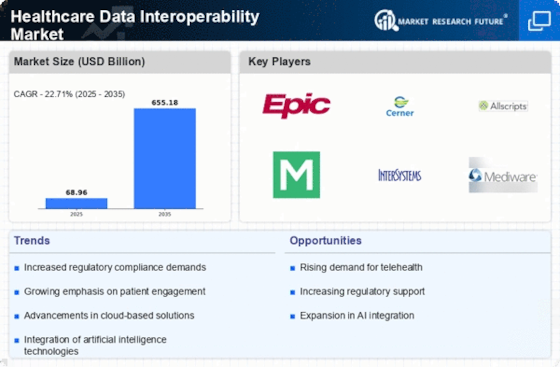

The Healthcare Data Interoperability Market is experiencing a notable surge in demand for integrated healthcare systems. This demand is driven by the need for seamless data exchange among various healthcare stakeholders, including providers, payers, and patients. As healthcare organizations increasingly recognize the value of interoperability in enhancing patient care and operational efficiency, investments in interoperable solutions are expected to rise. According to recent estimates, the market for healthcare interoperability solutions is projected to reach USD 4.5 billion by 2026, reflecting a compound annual growth rate of approximately 12%. This trend indicates a growing acknowledgment of the importance of integrated systems in delivering high-quality healthcare services.

Regulatory Initiatives Promoting Interoperability

Regulatory initiatives are significantly influencing the Healthcare Data Interoperability Market. Governments and regulatory bodies are implementing policies aimed at promoting interoperability among healthcare systems. These initiatives often include mandates for data sharing and the adoption of standardized protocols. For example, recent regulations in various regions require healthcare organizations to adopt interoperable electronic health record systems. Such policies are expected to drive the growth of the interoperability market, as compliance becomes a necessity for healthcare providers. The increasing regulatory focus on interoperability is likely to result in a market expansion, with projections indicating a potential growth rate of 15% annually as organizations strive to meet compliance requirements.