Rising Demand for Biopharmaceuticals

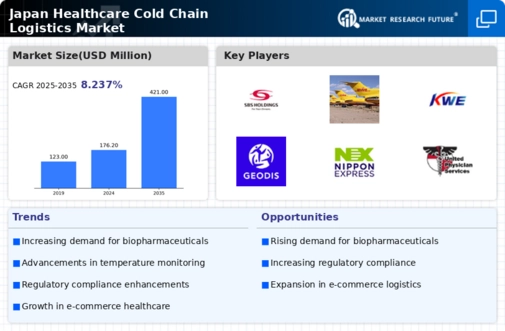

The Japan healthcare cold chain logistics market is experiencing a notable increase in demand for biopharmaceuticals, which require stringent temperature control during transportation. The biopharmaceutical sector in Japan is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years. This growth is driven by advancements in drug development and an increasing number of biologics entering the market. As a result, logistics providers are compelled to enhance their cold chain capabilities to ensure the integrity of these temperature-sensitive products. The need for specialized storage and transportation solutions is becoming more pronounced, thereby driving investments in cold chain infrastructure and technology. Consequently, the Japan healthcare cold chain logistics market is likely to expand significantly to accommodate this rising demand.

Aging Population and Increased Healthcare Needs

Japan's aging population is a critical driver for the healthcare cold chain logistics market. With over 28% of the population aged 65 and older, there is a growing need for healthcare services, including pharmaceuticals and medical devices that require cold chain logistics. The demand for vaccines, insulin, and other temperature-sensitive medications is expected to rise, necessitating robust cold chain solutions. According to government statistics, the healthcare expenditure in Japan is projected to reach 42 trillion yen by 2025, further emphasizing the need for efficient logistics systems. This demographic shift is prompting logistics companies to invest in advanced cold chain technologies to ensure timely and safe delivery of healthcare products, thereby fostering growth in the Japan healthcare cold chain logistics market.

Government Regulations and Compliance Standards

The Japan healthcare cold chain logistics market is heavily influenced by government regulations and compliance standards aimed at ensuring the safety and efficacy of healthcare products. Regulatory bodies, such as the Pharmaceuticals and Medical Devices Agency (PMDA), enforce strict guidelines for the transportation and storage of temperature-sensitive products. Compliance with these regulations is not only mandatory but also critical for maintaining product integrity. The increasing complexity of these regulations is driving logistics companies to adopt more sophisticated cold chain solutions. As a result, there is a growing demand for training and certification programs for personnel involved in cold chain logistics. This regulatory environment is likely to propel investments in infrastructure and technology within the Japan healthcare cold chain logistics market.

Focus on Sustainability and Environmental Impact

Sustainability is becoming a focal point in the Japan healthcare cold chain logistics market. As environmental concerns rise, logistics providers are increasingly adopting eco-friendly practices to minimize their carbon footprint. This includes the use of energy-efficient refrigeration systems and sustainable packaging materials. The Japanese government has set ambitious targets for reducing greenhouse gas emissions, which is influencing logistics companies to innovate and implement greener solutions. According to recent studies, companies that prioritize sustainability are likely to gain a competitive edge in the market. This shift towards sustainable practices not only aligns with consumer preferences but also enhances the overall efficiency of cold chain operations. Consequently, the Japan healthcare cold chain logistics market is expected to see a significant transformation as companies strive to meet both regulatory requirements and consumer expectations.

Technological Innovations in Cold Chain Monitoring

Technological innovations are transforming the Japan healthcare cold chain logistics market. The integration of IoT devices and real-time monitoring systems is enhancing the efficiency and reliability of cold chain operations. These technologies allow for continuous temperature tracking and data logging, which are essential for compliance with regulatory standards. The market for cold chain monitoring solutions in Japan is expected to grow significantly, driven by the need for transparency and accountability in the supply chain. Furthermore, the adoption of automation and robotics in warehousing and transportation is streamlining operations, reducing human error, and improving overall service quality. As a result, logistics providers are increasingly investing in these technologies to maintain competitiveness in the evolving healthcare landscape.