Increasing Focus on Sustainability

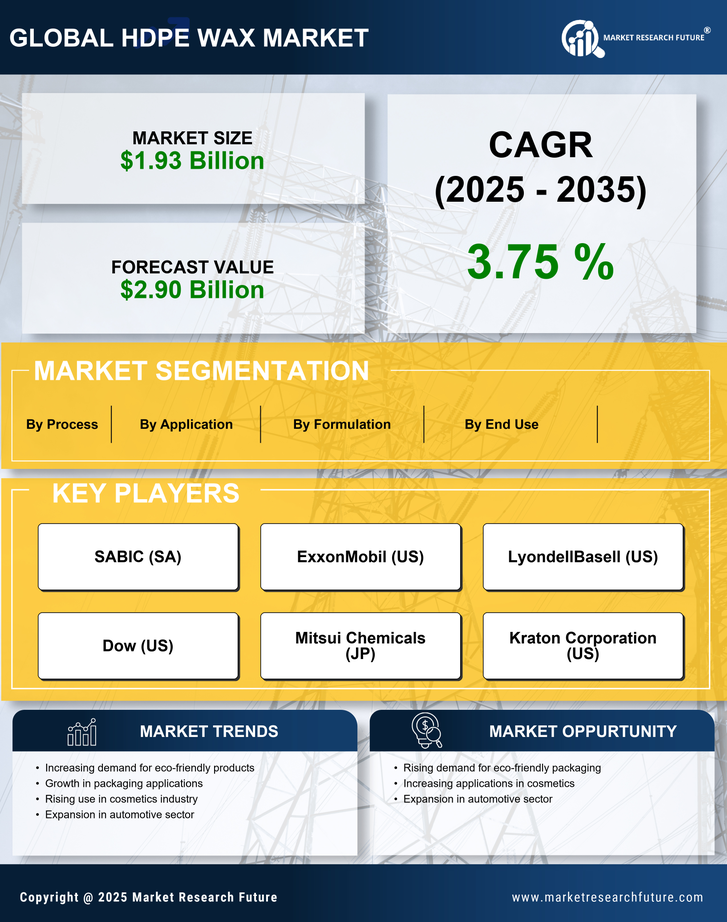

The HDPE Wax Market is increasingly driven by a focus on sustainability and environmental responsibility. As industries strive to reduce their carbon footprint, the demand for sustainable materials, including HDPE wax, is on the rise. This shift is particularly evident in sectors such as packaging, where companies are seeking alternatives to traditional petroleum-based waxes. The market for sustainable waxes is projected to grow significantly, with HDPE wax being recognized for its recyclability and lower environmental impact. Manufacturers are responding to this trend by developing eco-friendly formulations that align with sustainability goals. This growing emphasis on sustainable practices is likely to propel the HDPE wax market forward, as more companies adopt environmentally friendly materials in their production processes.

Expansion in Coatings and Adhesives

The HDPE Wax Market is witnessing substantial growth due to its expanding applications in coatings and adhesives. The demand for high-performance coatings, which utilize HDPE wax for its slip and anti-blocking properties, is on the rise. The coatings segment is expected to grow at a rate of around 5% annually, driven by the construction and automotive industries. HDPE wax enhances the durability and aesthetic appeal of coatings, making it a preferred choice among manufacturers. Additionally, the adhesive sector benefits from the incorporation of HDPE wax, which improves adhesion properties and thermal stability. As industries increasingly seek innovative solutions to enhance product performance, the role of HDPE wax in coatings and adhesives becomes increasingly pivotal, thereby driving the overall market.

Rising Demand in Packaging Industry

The HDPE Wax Market is experiencing a notable surge in demand, particularly from the packaging sector. As consumer preferences shift towards sustainable and eco-friendly packaging solutions, HDPE wax is increasingly favored for its excellent barrier properties and compatibility with various materials. The packaging industry, which is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years, is a significant driver for the HDPE wax market. This growth is attributed to the rising need for lightweight, durable, and recyclable packaging options. Consequently, manufacturers are investing in HDPE wax formulations that enhance the performance of packaging materials, thereby expanding the market's potential. The increasing focus on reducing plastic waste further propels the demand for HDPE wax in sustainable packaging applications.

Growth in Personal Care and Cosmetics

The HDPE Wax Market is significantly influenced by the growth in the personal care and cosmetics sector. With an increasing consumer inclination towards high-quality and natural products, HDPE wax is being utilized in various formulations, including creams, lotions, and lip balms. The personal care market is projected to expand at a rate of approximately 6% per year, creating a robust demand for HDPE wax as a thickening agent and emollient. Its compatibility with other ingredients and ability to enhance product texture make it a valuable component in cosmetic formulations. Furthermore, as brands focus on clean beauty trends, the demand for HDPE wax is likely to increase, positioning it as a key ingredient in the evolving landscape of personal care products.

Technological Innovations in Production

The HDPE Wax Market is benefiting from ongoing technological innovations in production processes. Advances in polymerization techniques and refining methods are enhancing the quality and efficiency of HDPE wax production. These innovations are expected to reduce production costs and improve the overall performance characteristics of HDPE wax, making it more appealing to manufacturers across various sectors. As production technologies evolve, the market is likely to see an influx of high-performance HDPE wax products that cater to specific industry needs. This trend not only supports the growth of the HDPE wax market but also encourages manufacturers to explore new applications and formulations, thereby broadening the market's scope.