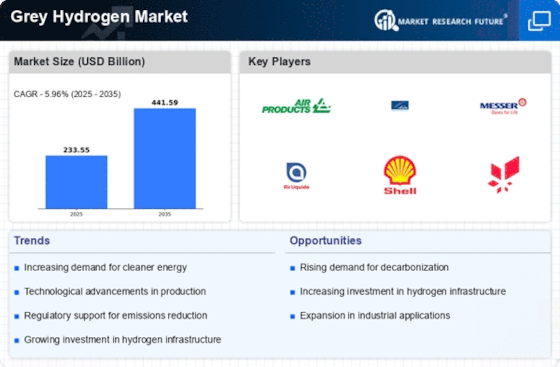

Cost-Effectiveness of Grey Hydrogen Production

The Grey Hydrogen Market benefits from the cost-effectiveness associated with its production methods. Grey hydrogen is primarily produced through steam methane reforming, which is a relatively low-cost process compared to other hydrogen production methods. In 2023, the production cost of grey hydrogen was approximately 1.5 to 2.0 USD per kilogram, making it an attractive option for industries looking to minimize expenses. This economic advantage is particularly appealing in regions where natural gas is abundant and inexpensive. As industries continue to prioritize cost management, the demand for grey hydrogen is likely to rise, reinforcing its position in the market. The financial viability of grey hydrogen production could potentially lead to increased investments in infrastructure and technology, further enhancing its market presence.

Government Policies Supporting Hydrogen Adoption

The Grey Hydrogen Market is influenced by government policies that promote the adoption of hydrogen technologies. Many governments are implementing regulations and incentives to encourage the use of hydrogen as a cleaner energy source. For instance, tax credits and subsidies for hydrogen production facilities have been introduced in several regions, making grey hydrogen more economically viable. In 2023, it was reported that government funding for hydrogen initiatives exceeded 10 billion USD, reflecting a strong commitment to developing the hydrogen economy. These supportive policies are likely to enhance the attractiveness of grey hydrogen, driving its adoption across various sectors. As regulatory frameworks evolve, the market for grey hydrogen may expand, creating new opportunities for stakeholders.

Technological Innovations in Hydrogen Production

The Grey Hydrogen Market is benefiting from technological innovations that enhance production efficiency and reduce costs. Advances in steam methane reforming technology and carbon capture utilization are making grey hydrogen production more efficient. In 2023, new technologies have been developed that improve the conversion rates of natural gas to hydrogen, potentially increasing output by 20%. These innovations not only lower production costs but also address environmental concerns associated with carbon emissions. As technology continues to evolve, the competitiveness of grey hydrogen in the energy market is likely to improve. The integration of innovative solutions may also attract investments, further propelling the growth of the grey hydrogen market.

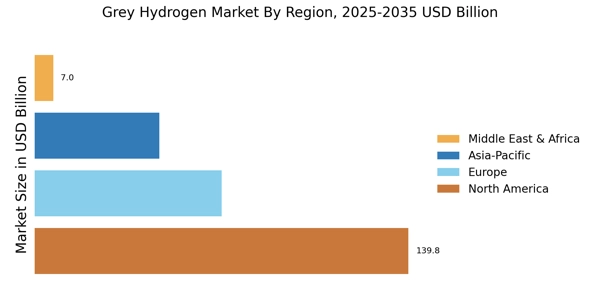

Infrastructure Development for Hydrogen Supply Chains

The Grey Hydrogen Market is poised for growth due to ongoing infrastructure development aimed at enhancing hydrogen supply chains. Investments in pipelines, storage facilities, and distribution networks are critical for ensuring a reliable supply of grey hydrogen to end-users. In recent years, several countries have initiated projects to expand their hydrogen infrastructure, with funding reaching billions of dollars. This development is essential for meeting the increasing demand from various sectors, including transportation and energy. As infrastructure improves, the accessibility and reliability of grey hydrogen are expected to increase, thereby stimulating market growth. The establishment of robust supply chains may also encourage new entrants into the market, fostering competition and innovation.

Rising Demand for Hydrogen in Industrial Applications

The Grey Hydrogen Market is experiencing a notable increase in demand driven by various industrial applications. Industries such as refining, ammonia production, and methanol synthesis are major consumers of hydrogen. In 2023, the hydrogen demand in the chemical sector was estimated to be around 70 million metric tons, with a significant portion derived from grey hydrogen. This trend is likely to continue as industries seek to enhance efficiency and reduce costs. Furthermore, the versatility of grey hydrogen in producing essential chemicals positions it as a critical component in the industrial landscape. As companies strive to meet production targets, the reliance on grey hydrogen is expected to grow, thereby propelling the market forward.