政府の支援と補助金

政府の農業生産性向上を目的とした施策は、グリーンハウスフィルム市場において重要な役割を果たしています。さまざまな国が、グリーンハウス技術に投資する農家に対して財政支援や補助金を提供する政策を実施しています。この支援は、農業が主要な経済ドライバーである地域で特に顕著です。例えば、作物の収量を向上させるためにグリーンハウスフィルムの使用を促進するプログラムが増加しています。このような施策は、グリーンハウスフィルムの採用を後押しするだけでなく、農業部門全体の成長にも寄与しています。市場アナリストは、政府の支援が今後数年でグリーンハウスフィルムの採用を15%増加させる可能性があると予測しており、政策がグリーンハウスフィルム市場を形成する上での重要性を強調しています。

映画制作における技術革新

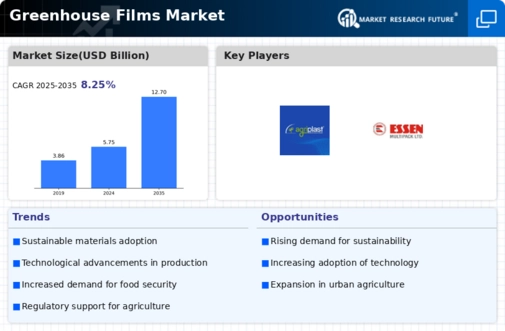

温室フィルムの生産における技術革新は、温室フィルム市場に大きな影響を与えています。UV安定化フィルムや防曇技術の開発などの革新は、温室フィルムの性能と耐久性を向上させます。これらの進展は作物保護を改善するだけでなく、植物の成長に不可欠な光の透過を最適化します。フィルム生産におけるナノテクノロジーの導入も注目に値し、フィルムの物理的特性を向上させ、より耐久性があり効率的にします。市場データによると、技術的に進んだフィルムのセグメントは、今後5年間で年平均成長率7%で成長することが予想されています。これは、革新的なフィルムソリューションを通じて農業生産性の向上が求められているため、温室フィルム市場が急速に進化していることを示しています。

都市化の進展とスペースの制約

都市化の傾向は、グリーンハウスフィルム市場に独自の課題と機会を生み出しています。都市地域が拡大するにつれて、耕作可能な土地の利用可能性が減少し、革新的な農業ソリューションの必要性が高まっています。都市農業や垂直庭園が人気を集めており、限られたスペースで利用できるグリーンハウスフィルムの需要が高まっています。この変化は、伝統的な農業が実施できない人口密度の高い地域において特に重要です。マーケットリサーチフューチャーによると、都市農業セグメントは、効率的な食料生産方法の必要性に駆動され、今後数年で20%成長する見込みです。したがって、グリーンハウスフィルム市場は、都市農業の実践に対応する製品に焦点を当てて、これらの変化するダイナミクスに適応する可能性が高いです。

持続可能な農業への需要の高まり

持続可能な農業慣行への強調が高まる中、温室フィルム市場の主要な推進力となっているようです。消費者が環境意識を高める中、農家は環境への影響を最小限に抑える方法を採用しています。この変化は、資源消費を削減しながら作物の収量を向上させるために設計された温室フィルムの市場の成長に反映されています。報告によると、温室フィルム市場は2026年までに35億米ドルに達する見込みであり、持続可能なソリューションの必要性が推進しています。生分解性およびリサイクル可能なフィルムの採用も進んでおり、農業部門のより広範な持続可能性目標に沿っています。この傾向は、持続可能性が農業慣行の核心原則となるにつれて、温室フィルム市場が堅調な成長を遂げる可能性が高いことを示唆しています。

新鮮な農産物に対する消費者の好み

新鮮で地元で調達された農産物に対する消費者の好みの高まりは、グリーンハウスフィルム市場に大きな影響を与えています。健康を意識した消費者が新鮮な果物や野菜を求める中、年間を通じて生産を確保するための効率的な農業慣行への需要が高まっています。グリーンハウスフィルムは、農家が制御された環境で作物を栽培するのを可能にし、消費者の品質と新鮮さに対する期待に応える重要な役割を果たしています。市場データによると、新鮮な農産物の需要は今後5年間で25%増加する見込みであり、これによりグリーンハウス技術の必要性がさらに高まっています。この傾向は、グリーンハウスフィルム市場が高品質で新鮮な農産物に対する消費者の好みに合致しているため、成長の準備が整っていることを示しています。