Research Methodology on Green Building Market

1. Introduction

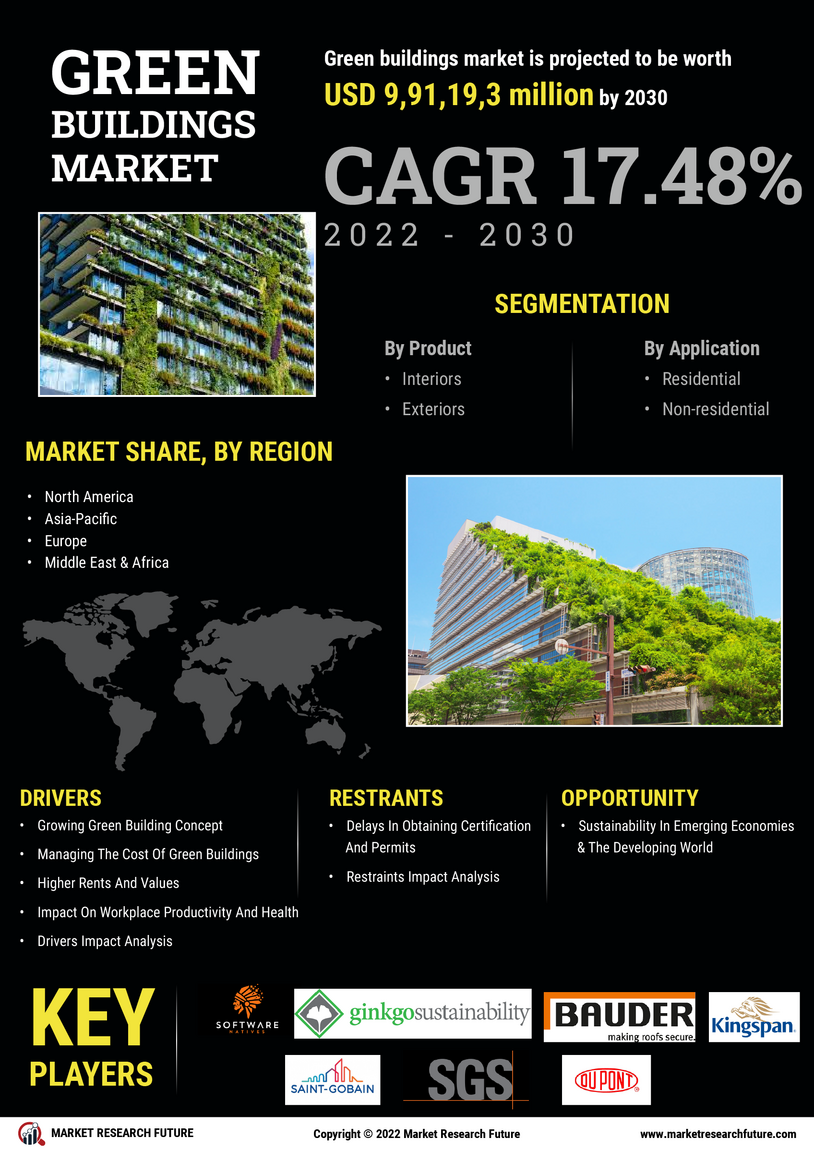

The research methodology provides an overview of the research process and strategies used in the Market Research Future (MRF) report on the Green Building Market. It includes detailed discussions of the research approach, the scope of the study, primary and secondary research objectives, data sources, sampling and information collected, data extraction methods, and data analysis approaches.

2. Research Approach

The research approach adopted by the MRFR team for the Green Building Market report is a combination of primary and secondary research approaches. The primary research approach involves collecting data through direct communication and interviews with industry experts, stakeholders and senior executives of the green building market. The secondary research approach includes an extensive literature review and analysis of secondary sources such as news articles, company reports, industry reports, and market reports.

3. Scope of the Study

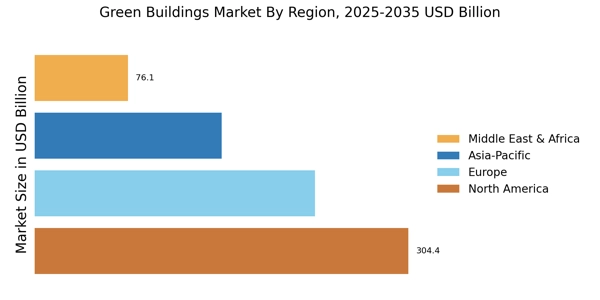

The scope of the report is to analyze the green building market based on global markets, major end-users, regions, and product types. The report provides a comprehensive and in-depth analysis of the current green building market and its prospects.

4. Primary and Secondary Research Objectives

The primary research objective of the report is to understand the market dynamics, key trends, and the competitive landscape of the global green building market. In addition, the report also aims to identify the major drivers and challenges in the market and recognize various opportunities that exist in the market.

The secondary research objective is to gain a better understanding of the global green building market, which is also done to analyze historical and current data and to get an indication of future market trends and performance.

5. Data Sources

The data sources used for the analysis of the global Green Building Market include both primary and secondary sources. Primary data sources utilized include interviews with key market players across the globe, government agencies, and other regulatory bodies. Secondary sources include annual reports, financial statements, investor presentations, industry and trade sources, and other published materials.

6. Sampling and Information Collected

To gain a comprehensive understanding of the market, data is collected through primary and secondary sources. Interviews and surveys are conducted with key industry players to gain insight into the competitive landscape, market dynamics, and trends in the global green building market. The samples collected are a mix of qualitative and quantitative data, which are analyzed to assess the market size, market share, competitive landscape, and growth opportunities.

7. Data Extraction Methodology

The data extraction methodology used for creating the research report on the Green Building Market involves collecting data from both primary and secondary sources. The primary sources include interviews with key industry players, government agencies, and other regulatory bodies. The secondary sources include industry and trade sources, annual reports, financial statements, and published materials.

8. Data Analysis Approach

The data analysis approach used for the report is a combination of both primary and secondary data analysis. The primary sources include interviews with key industry players, government agencies, and other regulatory bodies. The secondary sources include industry and trade sources, annual reports, financial statements, and published materials. The primary data is analyzed and interpreted to identify the major drivers and challenges in the market and recognize the various opportunities existing in the market. The secondary data is used to get an indication of past, present, and future market trends. The data is also used to assess the market size, market share, competitive landscape, and growth opportunities.

9. Finalizing the Report

The data analysis findings are verified and validated to ensure accuracy and reliability. The findings are then used to draft the conclusions and recommendations of the report which are then reviewed and finalized by the research team and the report is published.

10. Conclusion

The research methodology for the report on the Green Building Market includes primary and secondary research approaches. Primary data is collected through interviews and surveys with key industry players and secondary data is collected from industry and trade sources, annual reports, financial statements, and other published materials. The data is analyzed to identify the major drivers and challenges in the market and recognize the various opportunities that exist in the market. The findings are used to draft the conclusions and recommendations of the report.