North America : Innovation and Market Leadership

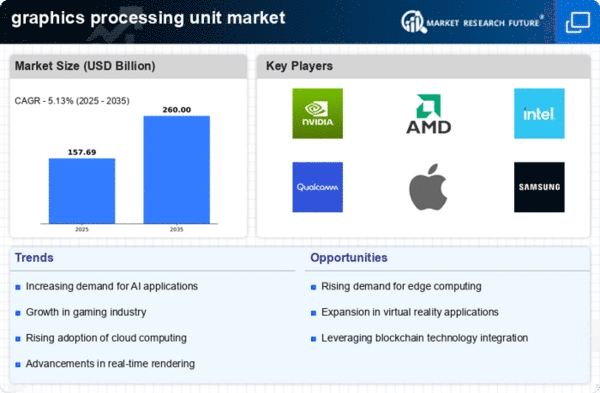

North America continues to lead the graphics processing unit (GPU) market, holding a significant share of 75.0% as of December 2025. The region's growth is driven by robust demand in gaming, AI, and data centers, alongside favorable regulations that support technological advancements. The presence of major players like NVIDIA, AMD, and Intel further fuels innovation and competition, ensuring a dynamic market landscape. The United States stands out as the primary contributor to this market, with California being a hub for tech innovation. Companies such as Qualcomm and Apple are also pivotal, enhancing the competitive environment. The region's focus on R&D and investment in cutting-edge technologies positions it as a leader in GPU development, catering to both consumer and enterprise needs.

Europe : Emerging Market with Growth Potential

Europe's GPU market is on the rise, currently valued at €35.0 billion. The region is experiencing increased demand for GPUs in sectors like gaming, automotive, and AI, driven by digital transformation initiatives. Regulatory support for tech innovation and sustainability is also a key growth driver, fostering an environment conducive to market expansion. Leading countries such as Germany, France, and the UK are at the forefront of this growth, with a strong presence of key players like AMD and Intel. The competitive landscape is characterized by collaborations and partnerships aimed at enhancing GPU capabilities. As Europe continues to invest in technology, the GPU market is expected to flourish, aligning with the region's digital economy goals.

Asia-Pacific : Rapid Growth and Innovation

The Asia-Pacific region, with a market size of $30.0 billion, is rapidly emerging as a significant player in the GPU market. The growth is fueled by increasing demand for gaming, mobile devices, and AI applications. Countries like China, Japan, and South Korea are leading this trend, supported by government initiatives promoting technology adoption and innovation. China, in particular, is witnessing a surge in GPU demand due to its booming gaming industry and advancements in AI. Major companies like Samsung and Micron are key players in this landscape, driving competition and innovation. As the region continues to invest in technology infrastructure, the GPU market is poised for substantial growth, catering to both local and global demands.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa (MEA) region, with a market size of $10.0 billion, presents significant growth opportunities in the GPU sector. The increasing adoption of digital technologies across various industries, including gaming and education, is driving demand for GPUs. Government initiatives aimed at enhancing digital infrastructure are also contributing to market growth. Countries like South Africa and the UAE are leading the charge, with investments in technology and innovation. The competitive landscape is evolving, with both local and international players entering the market. As the region continues to embrace digital transformation, the GPU market is expected to expand, unlocking new opportunities for growth and development.