Government Initiatives and Funding

Government initiatives aimed at enhancing broadband access are likely to play a pivotal role in the GPON Equipment Market. Various countries have launched programs to promote digital inclusion, particularly in underserved areas. For instance, funding for broadband expansion projects has surged, with billions allocated to improve infrastructure. This financial support encourages telecommunications companies to adopt GPON technology, which offers high-speed internet capabilities. As a result, the GPON Equipment Market is poised for growth, driven by public sector investments that aim to bridge the digital divide and ensure equitable access to high-speed internet.

Increasing Adoption of Smart Technologies

The proliferation of smart technologies, including smart homes and smart cities, appears to be a driving force in the GPON Equipment Market. As consumers and businesses increasingly seek high-speed internet connectivity to support these technologies, the demand for GPON equipment is likely to rise. According to recent data, the number of smart devices is projected to reach over 50 billion by 2030, necessitating robust broadband infrastructure. This trend indicates that service providers must invest in GPON solutions to meet the growing bandwidth requirements. Consequently, the GPON Equipment Market is expected to experience substantial growth as it aligns with the needs of an increasingly interconnected world.

Shift Towards Fiber-to-the-Home Solutions

The shift towards Fiber-to-the-Home (FTTH) solutions is likely to be a major catalyst for the GPON Equipment Market. As consumers increasingly prefer high-speed internet access directly to their homes, telecommunications companies are investing in GPON technology to deliver reliable and fast connections. Recent statistics indicate that FTTH deployments have been rising steadily, with millions of new subscribers added annually. This trend suggests that the GPON Equipment Market will continue to expand as more providers recognize the advantages of fiber optics in meeting consumer demands for speed and reliability.

Competitive Landscape and Market Consolidation

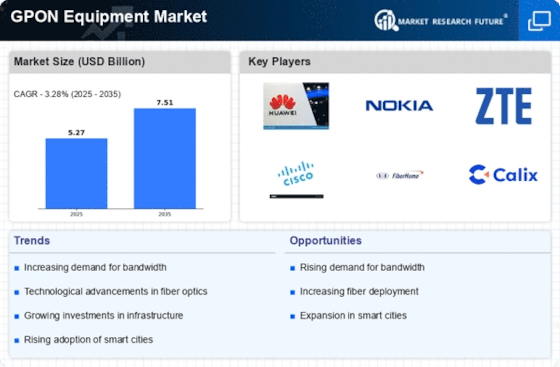

The competitive landscape within the GPON Equipment Market appears to be evolving, with increasing market consolidation among key players. Mergers and acquisitions are becoming more common as companies seek to enhance their technological capabilities and expand their market reach. This consolidation may lead to improved product offerings and innovation in GPON solutions, as companies pool resources and expertise. Market data indicates that the top five players currently hold a significant share of the market, suggesting that competition will drive advancements in technology and service delivery. As a result, the GPON Equipment Market is likely to witness dynamic changes in the coming years.

Rising Demand for Bandwidth-Intensive Applications

The increasing prevalence of bandwidth-intensive applications, such as 4K video streaming, online gaming, and cloud computing, is expected to significantly impact the GPON Equipment Market. As users demand higher data rates, service providers are compelled to upgrade their networks to accommodate these needs. Market data suggests that The GPON Equipment Market alone is projected to exceed 100 billion USD by 2025, further driving the necessity for advanced GPON solutions. This trend indicates that the GPON Equipment Market must evolve to support the growing appetite for high-quality digital content and services.