Competitive Landscape

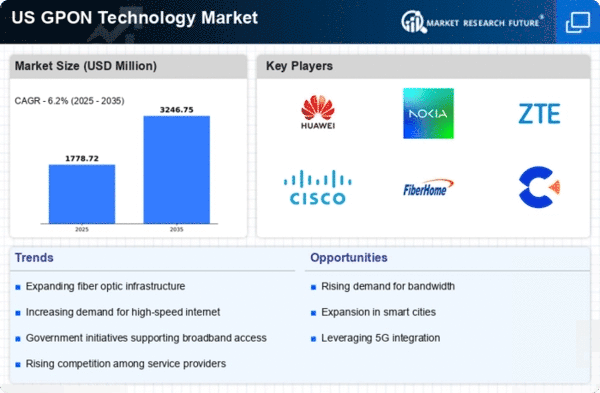

The gpon technology market is characterized by a highly competitive landscape, with numerous players vying for market share. This competition is driving innovation and improvements in service offerings, as companies strive to differentiate themselves. Recent reports suggest that the market is projected to grow at a CAGR of approximately 15% over the next five years, fueled by advancements in technology and increasing consumer expectations. Companies are focusing on enhancing their gpon solutions to provide faster speeds and more reliable connections. This competitive environment encourages investment in research and development, leading to the introduction of new features and capabilities in gpon technology. As a result, the gpon technology market is likely to witness continuous evolution, with firms adapting to changing market dynamics and consumer preferences.

Increased Internet Usage

The gpon technology market is experiencing a surge in demand due to the rising internet usage across various sectors in the US. As more individuals and businesses rely on high-speed internet for daily operations, the need for robust and efficient connectivity solutions becomes paramount. Recent data indicates that internet traffic has increased by over 30% in the last year alone, highlighting the necessity for advanced technologies like GPON. This trend is particularly evident in urban areas where population density drives the need for faster internet services. Consequently, service providers are investing heavily in gpon technology to meet consumer expectations and enhance user experience. The gpon technology market is thus positioned to benefit from this growing reliance on digital connectivity, as it offers scalable solutions that can accommodate increasing bandwidth demands.

Rising Adoption of Smart Technologies

The The GPON technology market is significantly influenced by the increasing adoption of smart technologies in the US. As households and businesses integrate smart devices into their environments, the demand for high-speed internet connectivity intensifies. Smart home devices, IoT applications, and connected systems require reliable and fast internet to function optimally. The proliferation of these technologies is expected to drive the gpon technology market, as it provides the necessary infrastructure to support multiple devices simultaneously. Furthermore, the market is projected to expand as more consumers recognize the benefits of gpon technology in enhancing their smart technology experiences. This trend indicates a shift towards more interconnected living and working environments, further solidifying the role of gpon technology in meeting the demands of modern connectivity.

Regulatory Support for Broadband Expansion

The The GPON technology market is benefiting from regulatory support aimed at expanding broadband access across the US. Government initiatives are increasingly focused on bridging the digital divide, particularly in rural and underserved areas. Recent legislation has allocated substantial funding to improve internet infrastructure, which is likely to enhance the deployment of gpon technology. This support is crucial for service providers looking to expand their networks and offer high-speed internet to a broader audience. As a result, the gpon technology market is expected to see increased investment and growth opportunities, driven by favorable policies and funding aimed at enhancing connectivity. This regulatory environment fosters a conducive atmosphere for the expansion of gpon technology, ultimately benefiting consumers and businesses alike.

Growing Demand for Cost-Effective Solutions

The The GPON technology market is witnessing a growing demand for cost-effective solutions as businesses and consumers seek to optimize their expenditures on internet services. With the rising costs of traditional broadband services, gpon technology offers a more economical alternative, providing high-speed internet at lower operational costs. This cost efficiency is particularly appealing to small and medium-sized enterprises (SMEs) that require reliable connectivity without incurring excessive expenses. Recent analyses indicate that gpon technology can reduce operational costs by up to 20% compared to conventional fiber solutions. As more users become aware of these advantages, the gpon technology market is likely to experience increased adoption, driven by the need for affordable yet high-quality internet services.