Adoption of 5G Technology

The rollout of 5G technology in South Korea is anticipated to have a profound impact on the gpon technology market. As 5G networks require robust backhaul solutions, gpon technology is emerging as a viable option to support the increased data traffic. The South Korean government has set ambitious goals for 5G coverage, aiming for 90% penetration by 2026. This expansion necessitates the integration of gpon technology to ensure seamless connectivity and high-speed data transfer. Consequently, the gpon technology market is likely to experience growth as telecom operators invest in upgrading their infrastructure to accommodate the demands of 5G services.

Emergence of Smart Home Technologies

The rise of smart home technologies in South Korea is driving demand for advanced connectivity solutions, thereby impacting the gpon technology market. As consumers increasingly adopt smart devices, the need for reliable and high-speed internet becomes paramount. It is projected that by 2025, over 50% of households will have at least one smart home device, necessitating robust internet infrastructure. Gpon technology, with its ability to deliver high bandwidth and low latency, is well-suited to meet these requirements. The gpon technology market is likely to see growth as service providers enhance their offerings to cater to the evolving needs of smart home users.

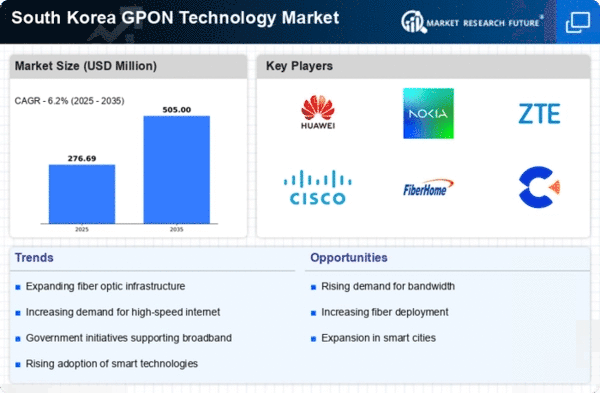

Increasing Fiber Optic Infrastructure

The expansion of fiber optic infrastructure in South Korea is a pivotal driver for the gpon technology market. With the government and private sector investing heavily in fiber networks, the country aims to enhance connectivity and support the growing demand for high-speed internet. As of 2025, it is estimated that over 80% of households in urban areas are connected to fiber networks, which significantly boosts the adoption of gpon technology. This infrastructure development not only facilitates faster internet speeds but also supports various applications such as smart homes and IoT devices. The gpon technology market is likely to benefit from this trend, as more service providers seek to upgrade their networks to meet consumer expectations.

Rising Consumer Expectations for Bandwidth

In South Korea, consumer expectations for bandwidth are escalating, driving the gpon technology market. As digital services proliferate, including streaming, gaming, and remote work, users demand higher speeds and more reliable connections. Recent surveys indicate that approximately 70% of consumers prioritize internet speed when choosing service providers. This shift in consumer behavior compels telecom companies to invest in gpon technology, which offers superior bandwidth capabilities compared to traditional copper networks. The gpon technology market is thus positioned to grow as providers strive to meet these heightened expectations, potentially leading to increased competition and innovation in service offerings.

Government Policies Promoting Digital Transformation

Government policies in South Korea aimed at promoting digital transformation are significantly influencing the gpon technology market. Initiatives such as the Digital New Deal, which allocates substantial funding for digital infrastructure, are designed to enhance connectivity across the nation. By 2025, the government plans to invest over $10 billion in digital infrastructure projects, which include expanding fiber optic networks and supporting gpon technology deployment. These policies not only facilitate the growth of the gpon technology market but also encourage private sector participation, fostering a collaborative environment for innovation and development in telecommunications.