Expansion of the Beverage Sector

The expansion of the beverage sector is a crucial driver for the Glucose And Fructose Market. With the proliferation of new beverage products, including energy drinks, flavored waters, and soft drinks, the demand for sweeteners has escalated. Recent statistics reveal that the beverage industry is anticipated to grow at a rate of approximately 6% per year, which is likely to increase the consumption of glucose and fructose. These sweeteners are favored for their ability to enhance flavor while providing a desirable sweetness profile. As beverage manufacturers continue to innovate and diversify their offerings, the Glucose And Fructose Market is poised to experience substantial growth, driven by the need for effective sweetening solutions.

Increasing Demand for Processed Foods

The rising demand for processed foods is a pivotal driver in the Glucose And Fructose Market. As consumers increasingly seek convenience, the food and beverage sector has witnessed a surge in the use of glucose and fructose as sweeteners and preservatives. According to recent data, the processed food market is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. This growth is likely to bolster the demand for glucose and fructose, as manufacturers look to enhance flavor profiles and extend shelf life. Consequently, the Glucose And Fructose Market is expected to benefit from this trend, as these sweeteners are integral to the formulation of various products, including snacks, beverages, and baked goods.

Technological Advancements in Production

Technological advancements in the production of glucose and fructose are significantly influencing the Glucose And Fructose Market. Innovations in extraction and processing techniques have led to more efficient production methods, reducing costs and improving product quality. For instance, advancements in enzymatic processes have enhanced the yield of glucose and fructose from various sources, making them more accessible to manufacturers. This efficiency is likely to stimulate market growth, as producers can meet rising demand without compromising on quality. Furthermore, these technological improvements may lead to the development of new applications for glucose and fructose, further expanding their role in the food and beverage sectors. The Glucose And Fructose Market is thus expected to benefit from these ongoing advancements.

Regulatory Support for Natural Sweeteners

Regulatory support for natural sweeteners is emerging as a significant driver in the Glucose And Fructose Market. Governments and health organizations are increasingly endorsing the use of natural sweeteners as part of dietary guidelines, promoting their consumption over artificial alternatives. This regulatory backing is likely to enhance consumer confidence in glucose and fructose, positioning them as preferable options in various food products. Market analysis suggests that this trend could lead to a rise in the adoption of glucose and fructose in formulations, particularly in health-oriented products. As the Glucose And Fructose Market aligns with regulatory trends, it may witness increased growth opportunities, driven by a favorable policy environment.

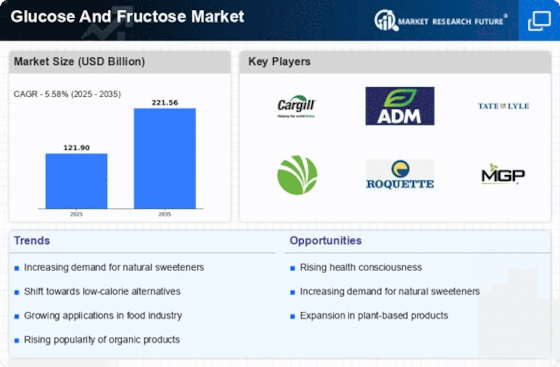

Health Consciousness and Sugar Alternatives

The increasing health consciousness among consumers is driving a notable shift towards sugar alternatives, thereby impacting the Glucose And Fructose Market. As individuals become more aware of the health implications associated with excessive sugar consumption, there is a growing preference for products that utilize glucose and fructose as healthier sweetening options. Market data indicates that the demand for low-calorie sweeteners is expected to rise significantly, with projections suggesting a growth rate of around 5% annually. This trend is likely to encourage manufacturers to reformulate their products, incorporating glucose and fructose to cater to health-conscious consumers. The Glucose And Fructose Market stands to gain from this shift, as these sweeteners offer a balance between taste and health benefits.